There are quite a few people who avoid investing altogether because of the wild gyrations of the market. To some, the market seems like a casino. I’d be better off putting my money on red and spinning.

It’s hard to argue against this when just this year, we’ve seen the Dow gain or lose over 1,000 points in a single trading session.

In order to feel safe investing, it helps to have a better idea of what drives market price changes.

Stock Market Indexes

Let’s start with the 3 key stock indexes. When we talk about the market, we’re generally talking about the Dow Jones Industrial Average (the Dow), the Standard & Poor 500 Index (S&P 500) or the National Association of Securities Dealers Automated Quotations (NASDAQ).

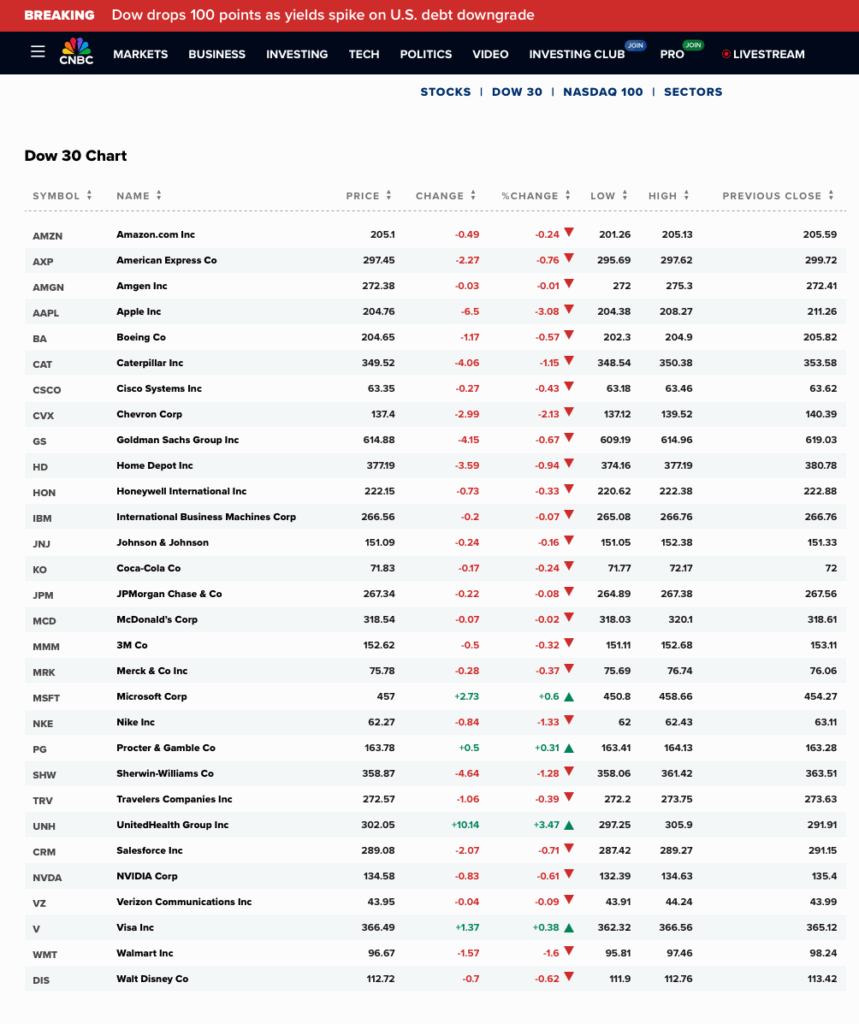

Each of these is an index. Simply put, an index is a group of companies chosen to represent a slice of the market. The Dow contains 30 stocks chosen by the Dow Jones corporation to represent the US industrial sector. It includes names like Walmart, Nike, ExxonMobil and Caterpillar.

It wouldn’t make sense to measure the market’s change based on a single company, so we have indexes made up of a collection of companies that give us a broader view of the change.

The Market’s Up!

…or down. Either way, we’re generally talking about a change in one or more of the market indexes.

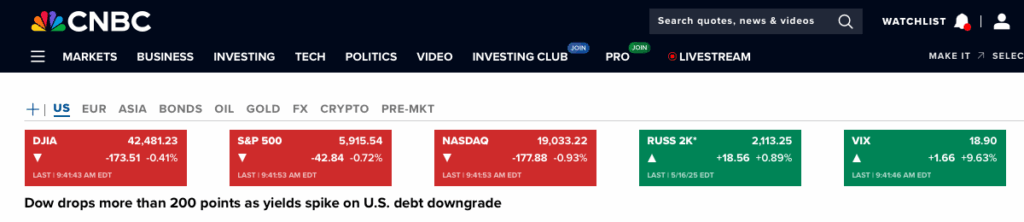

Today, the market is down. All 3 of the indexes we talked about are down. The Dow is down .41%, while the NASDAQ is down more than twice that, at .93%.

This is typical. The NASDAQ has a higher percentage of tech companies and tends to be more volatile. We’ll typically see a higher % change in the NASDAQ than the Dow or the S&P 500.

Why?

Let’s use the Dow as an example. It is down today. The reason it is down is because the stock price of its components is down.

But that’s not entirely true. Microsoft, Procter & Gamble, United Health, and Visa are up. But yeah, all the others are down.

The Dow is a price weighted index. Visa, which has a stock price of $366.49 has more than 2X greater influence on the index price than Nvidia, which has a stock price of $134.58. If you’re thinking that doesn’t make sense, I’m with you. Stock price is pretty arbitrary. I prefer the methodology of the S&P 500, which is a market-weighted index. Larger companies are weighted higher.

In the S&P 500, Visa, which has a market cap of $703 billion has a 4X smaller influence on the index than Nvidia, which has a market cap of $3.3 trillion.

To recap, Visa, a smaller company than Nvidia, has a greater influence on the price of the Dow than Nvidia does because of its higher share price, but has a smaller (than Nvidia) impact on the price of the S&P 500 because it has a smaller market cap.

Luckily, there are lots of indexes, so you can pick one with companies and weightings you like.

Stock Price Changes

OK, so now we understand that the individual price changes for the companies that make up the index drive the index change that we see on CNBC, but what causes a stock price to change?

Let’s say we’re excited about Nvidia. We decide to buy some shares. Let’s take a quick look at yahoo finance.

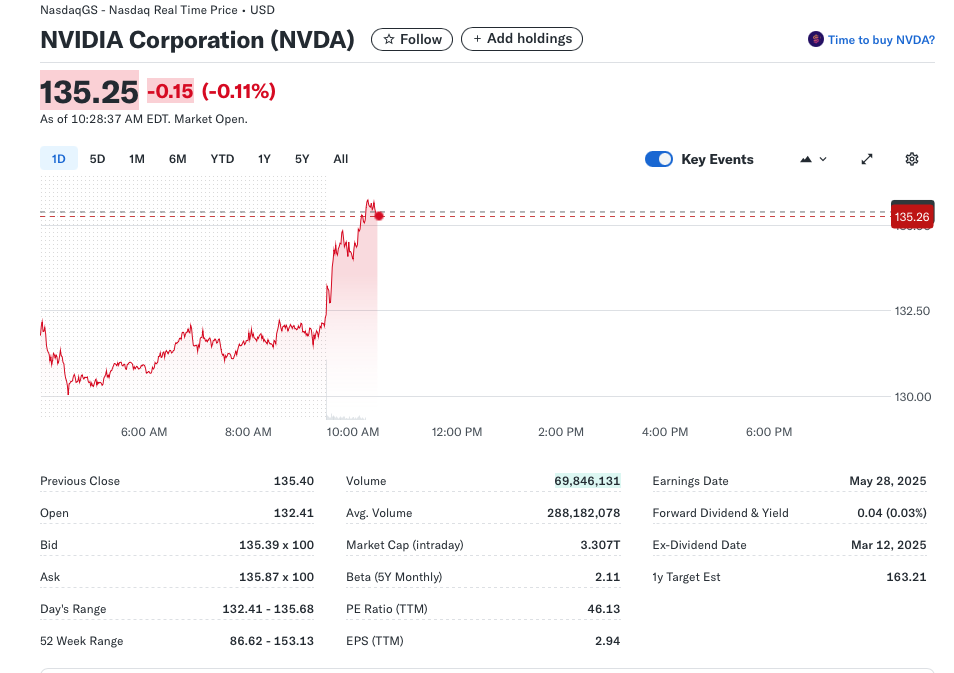

There are 3 important price numbers on this page. The big 135.25 up top is the price paid for the most recent Nvidia trade. This is ancient history. That trade has already happened.

The important prices for us are the bid and the ask.

The bid is 135.39 x 100. That means, someone has offered to buy 100 shares of Nvidia for $135.39 per share. That’s more than the last trade price of $135.25, but that doesn’t matter – that’s already happened.

Someone who has 100 shares is offering to sell them for $135.87. There are many more traders out there who are making offers to buy or sell, but Yahoo is showing us the highest bid and the lowest ask.

At this particular nanosecond in time, no trading on Nvidia is happening. The highest bid and the lowest ask are $0.48 apart.

Let’s refresh our screen.

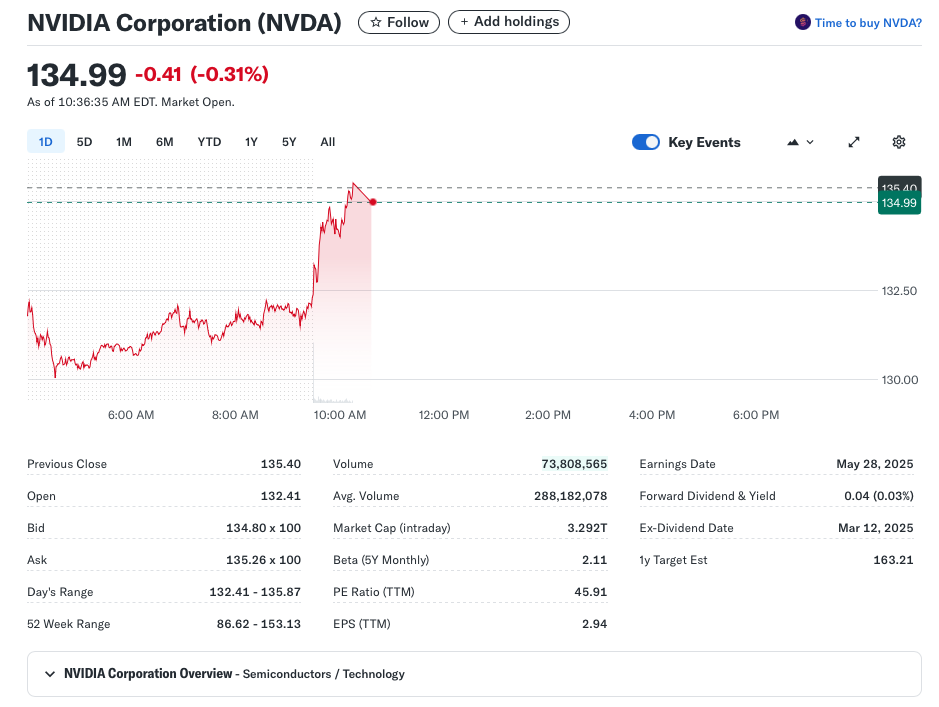

Lots of trades have happened in the last 8 minutes (I went downstairs to get a coffee…) Yahoo is nice enough to show us the volume so we know that (73,808,565 – 69,846,131 =) 3,962,434 shares have changed hands in those 8 minutes. And the bid and ask prices are quite a bit lower.

The market has only been open for about an hour, and there is quite a bit of activity. 73 million shares have been traded. The trade price has ranged from 132.41 up to 135.87. If we look at today’s chart, we can see that we dipped after market open, the price rose steadily, spiked, then pulled back a bit.

Why?

I like to scroll down and see if there is any news that would be causing these price changes? Yahoo nicely aggregates that for us.

The debt downgrade will cause overall market pessimism, but there isn’t any big news for Nvidia. So why did the price change?

No one really knows. During market open, there is a constant barrage of bids and asks. Why was the bid for Nvidia about 60 cents lower at 10:36am? Emotions, fear, unrelated news that “could be impactful”.

Lots of traders, and computers, are out there trying to make a quick buck. They are essentially reading the tea leaves to try and find some indication that is likely to cause a swing in price in the next 60 seconds. Then they trade thousands of shares in the hopes of making a quick buck.

Noise

I think of this as noise. There is a lot of noise in the background that causes fluctuation in prices. Sometimes this is small like our 60 cent change in Nvidia over 10 minutes, but sometimes it is huge. The whole Gamestop debacle back during COVID was a great example. Rumors, speculation, and collusion drove the price of Gamestop to the moon, and then back.

Gambling v. Fundamentals

Some people made a fortune on Gamestop. Some lost their life savings. Trading on Gamestop, or trading in general seems like gambling to me. We could win, we could lose. And the market favors the math whiz’s and the computers.

Investing on fundamentals is different.

Buying a Pizza Joint

Nothing puts readers to sleep faster than discussing the fundamentals of stocks. So let’s go with a story.

You and I have decided to invest in a local pizza place. We’re going to pool our money, buy one and run it ourselves. How fun! Well it’s not just fun, we are going to rely on the profits to live off of.

And just our luck, there are 2 available in our neighborhood. That’s cool, but how do we choose?

We discuss. We could choose the one with the best pizza, the one in a nicer location, the cleaner one….there are lots of ways to decide. But we’re looking to make money. We want the one with the highest return on our investment. Business fundamentals will tell us this.

Earnings

There are lots of fundamentals to look at, but one of my favorites is earnings. We want the pizza place with the best earnings. Per Investopedia:

Yup, that’s what we want. We want to buy the pizza joint that leaves us with the most money in our pocket after we’ve paid expenses.

So as an investor (v. a gambler) we are looking to buy shares of a company that earns more than other companies.

Earnings & Stock Price

In general, a company with higher earnings is more valuable and will have greater long-term stock price appreciation. It’s just like our pizza scenario. More earnings make for a more valuable company.

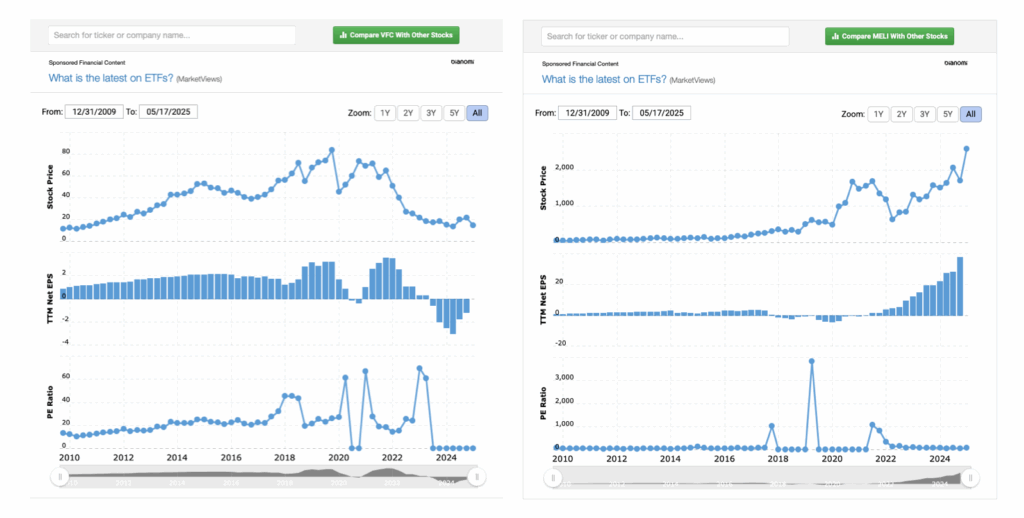

Let’s look at 2 examples from my portfolio. I held VF Corp for a while. It was not a good experience for me. And I am a proud shareholder of Mercardo Libre. Let’s compare the 2.

VF Corp is on the left. Earnings (the middle chart) have plummeted. They are now negative so the company is losing money. Not a great business strategy. The stock price has dropped as well. As a shareholder, the value of your shares have decreased along with the company’s earnings decrease.

On the right side is Mercardo Libre. Earnings are increasing every quarter. The price is up as well.

Which would you rather own?

Mutual Funds and ETFs

Many of us own Mutual Funds and ETFs. These are baskets of securities and much like indexes, the Mutual Fund or ETF price varies based on the securities that the fund or ETF holds. If I own an S&P 500 Index fund, my fund owns shares of the 500 companies in the index. My fund’s price will change based on the price changes of the underlying securities, just as the index itself does.

Wrap Up

Short term price movements can be arbitrary. As investors, we need to understand that our stocks may become out-of-favor as Netflix did back during the quickster debacle. Sometimes there is a reason, sometimes not. This can last for days, months or years. The market is a group of people (and computers) bidding on shares. Strange things can happen in the short term.

But long term, company fundamentals, especially earnings, tend to drive stock price movement. Mercardo Libre is becoming a more valuable company because it is earning more every quarter. It is becoming more efficient and it is entering new markets like payment processing. As a more valuable company, investors are willing to pay more for its shares. The bids are going higher and those that hold shares can ask more when selling.

VF Corp is moving in the opposite direction. And you can tell by the articles that Yahoo Finance shows us. Bad fundamentals, laying off employees, 3 reasons to sell. Not a great sign for investors.

And the stock price bears this out. I bought shares around $80 per share. I sold at $20 (ouch). Shares are around $14 today.

The price gyrations of the market indexes, individual stocks that comprise them, and of the mutual funds that we own, may seem random in the short term. And unfortunately, short-term can sometimes be weeks, months or even years. But over long periods of time, fundamentals tend to correlate very closely to price.

As a long-term investor, with plans to hold my investments for 10, 20, or even 30 years, small price fluctuations along the way are meaningless.