After yesterday’s post on how to begin using our 401k, I started to think more about choosing investments.

For many of us, the first question when choosing an investment is “is it safe?“

What Does Safe Mean to You?

I’m serious.

Safe can mean different things to different people and it can mean different things to each of us at different stages in our investing lives.

Typically, we think of a bank account as a safe investment. I can go to Bank of America today and put $100,000 in a savings account. That’s safe. It’s FDIC insured, meaning that if Bank of America fails, the FDIC will pay me back my $100,000.

I can’t lose my money. That’s safe.

Terms

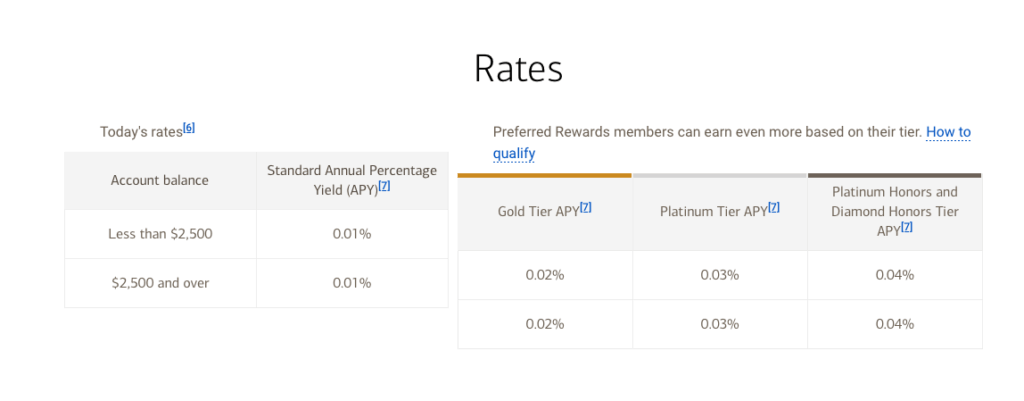

Let’s look at the terms of my savings account. I put in $100,000. Let’s see what Bank of America offers.

Assuming that my $100,000 deposit gets me to platinum tier, I’ll get 0.04% interest per year. That’s a cool $40 per year in interest. For my $100,000

Yes, I can take my $100,000 back anytime I like. If the bank goes under, I’ll get my $100,000 back, so that’s safety of my principal, so yes, in that respect it is a safe choice.

Return

But doesn’t return factor into safety as well?

I do some biking each summer. My bike is 40 years old and I’ve never replaced the tires or the inner tube. I have a very slow leak which means I need to fill it up before every trip. I know I have a slow leak, but for some reason (cheapness?) I live with it.

Our Bank of America savings account has a slow leak.

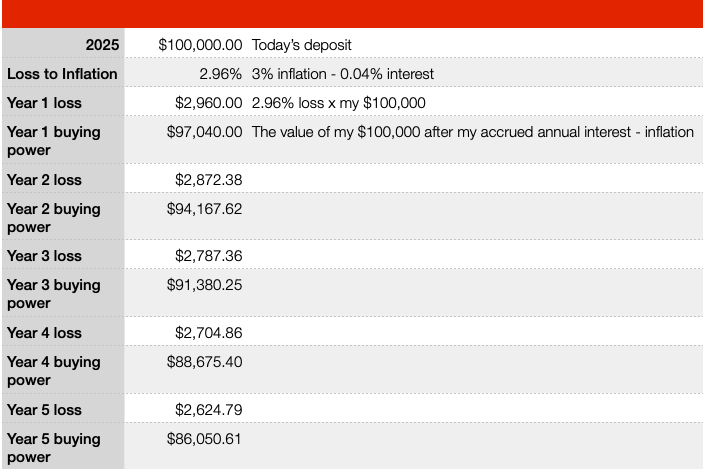

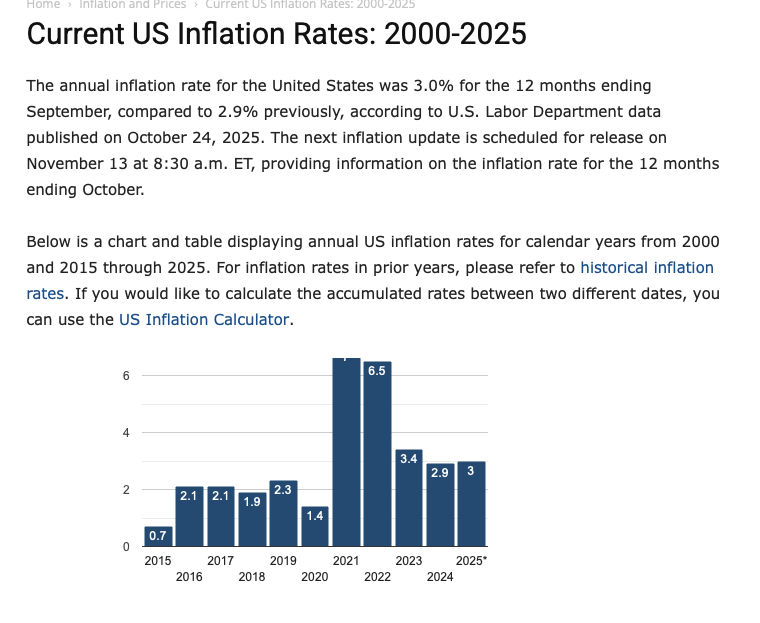

The 0.04% in interest lags the approximately 3% current level of inflation.

And inflation has averaged roughly 3% over the past 100 years or so. This means that we’re losing about 2.96%, or $2,960 per year. More details below.

Our $100,000 is slowly losing its buying power. It’s still $100,000, but we can’t buy as much stuff with it.

Re-Thinking Safety

So, part of my definition of safety should consider maintaining the current value of the $100,000. I would like it if my $100,000 that I put in today could buy $100,000 worth of stuff in 2030, or 5 years from now, but look:

After 5 years, my $100,000 is still $100,000 (actually a bit more because I earned a few dollars in interest each year), but it is less than $101,000…anyway, because my buying power drops every year, that money can only purchase $86,050 worth of goods and services.

My account has a slow leak. It lost $4,000 in buying power over 5 years. Where will I be in 20?

My Idea of Safety

I don’t think money in a Bank of America savings account is safe. Inflation will slowly eat away my buying power.

Remember when a gallon of gas cost less than a buck? Inflation has gotten a lot of press lately, but it’s been working in the background over the years and it may have creeped up on you. Check here.

For me, safety at least means that I’ll retain buying power.

But that’s not all. I am collecting social security, and at 65, I’ll get a few hundred dollars from a pension plan I have from an old employer, but those together will barely cover my medical costs. I’d also like to eat and maybe play some golf.

So for me, to truly be safe, I need my money to be working for me, because I no longer have a regular paycheck.

Making Our Money Work

This sounds great, and it’s easy for a billionaire like Warren to say, but what does the average person do about this?

Asset Allocation

While it sounds complicated, Asset Allocation is really about making reasonable decisions about where to put our money. Read more here and here.

We all need to have 4 buckets for our money. Click on the links to learn more.

- Emergency fund – we need to put money aside for a major expense like when our transmission fails or we have an unexpected hospital bill. Financial experts tell us we should have 6 month’s salary in our emergency fund. No one starts with this. Start with a few bucks and add to it over time. A little is better than none. And we don’t invest this money. It needs to be there always and we don’t worry about inflation.

- Checking account – this is where we keep the money to pay our bills – rent, mortgage, car payment, electricity…

- Bonds and Bond funds (fixed income) – Read more about bonds here. Bonds and bond funds are less volatile than stocks, but they tend to return less than stocks. A 5 year treasury bond pays about 3.5% interest and is backed by the full faith and credit of the US government. Pretty safe. A junk corporate bond may pay 6% or 7% but there is a chance that the company may not be able to make its payments or return principal. Bonds have risk.

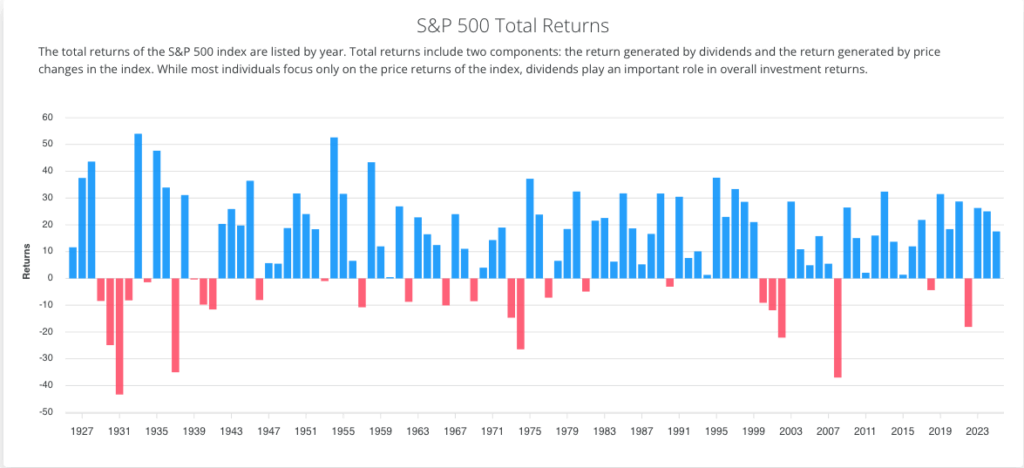

- Stocks and Stock funds (equities) – Read more here. Stocks are called equities because we own a piece of a business. Ownership has risks, but in the long run, a portfolio of stocks has historically returned more than bonds. The S&P 500 – an index that consists of the 500 largest publicly traded US companies has returned on average 10% per year with dividends reinvested over the last 100 years or so. There are plenty of S&P 500 funds and ETFs for us to invest in.

Asset allocation is about deciding how much to put in each bucket.

Funding buckets 1 and 2 sufficiently allows us to invest in buckets 3 and 4 without worrying about market volatility.

When I know that I have cash on hand to cover my monthly bills and to pay for an unexpected emergency, I’m not so worried when my 401k balance drops by 5%. It’s frightening to see the balance go from $100,000 to $95,000 in a single day. I just lost $5,000!!! But it’s tolerable for me as long as I don’t need that $5,000 to pay the rent.

Investing

Once we’ve got our emergency fund started and we’re comfortable that we can pay our bills from our checking account, it’s time to start investing.

I’m not trying to over-simplify here. Getting the emergency fund started and paying our bills is often a struggle. Never mind putting aside money for investing. It’s hard. Read my posts on saving here and here for some ideas. Ideally we can find ways to save without depriving ourselves, but sometimes it hurts a bit.

The great thing about investing today is that I can open a brokerage account at Fidelity or Vanguard for free. I can have a piece of my paycheck directed into that account. I can buy most stocks, bonds and mutual funds for free. I can buy fractional shares so that I can buy a small piece of a company. I have lots of options.

How to Start

a 401k plan is a great place to start. Learn more here and here.

But that’s not the only way.

Here’s how I started.

I bought a mutual fund. My first fund was the Vanguard Primecap fund. I was in my early 20s. I liked the name and I’d heard good things about Vanguard. It sounded like a good investment. Nothing was online back then, and Vanguard sent me a prospectus in the mail, but I’m sure I didn’t read it.

The fund did pretty well. I wish I still had shares today.

But once I bought shares, I started checking my performance, comparing my fund to others, trying to see why one fund performed better than another.

Slowly I learned.

I made some good picks and bad picks. I learned from both.

The S&P 500

Much later on, I learned about the S&P 500, and about stock and bond indices. We can buy a mutual fund or ETF that tracks one of these indices.

Are they safe?

No mutual fund guarantees your principal. They can, and some do, lose money for shareholders.

The risk that comes with any investment is the price we pay for the potential for building our wealth.

The S&P 500 is volatile. It is up over 16% this year, after being up more than 20% in both 2024 and 2023. That’s good volatile.

But look at the 100 year history. Read more at slickcharts. 2022 was down 18.11% – that’s bad volatile.

Make Your Own Safety

In my how do I know the S&P 500 will go up post, I talk about why I believe that the S&P 500 will continue to be a wealth-builder.

But, having said that, there are risks involved. One risk is certainly the pain we feel in 2008 or 2022 when our S&P 500 fund dropped 18% or more. Those years hurt.

But what would really hurt is having all of our money in the S&P 500 in 2022 and needing that money to pay bills.

Let’s say I’m retiring in 2022. I have my $100,000 in a nice S&P 500 fund. I plan to spend a piece of that as a down-payment on my retirement home.

Uh Oh, the S&P dropped 18.11%. I need to sell shares at the lowest price they’ve been in years. I’ll have to sell more shares than I would have had to sell last year which also limits my future growth.

Had I been thinking about asset allocation, I would not have had money that I need to spend in the next 5 years invested in equities.

I would have moved the money for the down-payment into cash and bonds in 2017. The market was up 21.83% in 2017, so it was a good time to sell, and I would have put most of the money in a money market fund, and I would have put some in a short term low risk bond index fund.

The money market fund pays a little interest but my money is reasonably safe, though not FDIC insured. Read more about different types of cash investments here.

The bond index is lower volatility than stocks, but will have a higher return than the money market fund. This protects me from the effects of inflation.

This isn’t a guarantee, but it seems pretty safe.

Wrap Up

There are many ways to think about safety.

Safety today may mean not losing money, but that comes at the expense of my future safety (i.e not having to eat cat food in retirement).

For me, safety means protecting my wealth while still growing my assets so that I can live the retirement I want.

Having a solid asset allocation strategy and reviewing and adjusting annually provides me with a level of safety.

Investing is necessary. Luckily, it’s easy to do today and we can start with just a few dollars. Open an account and invest $10. You may lose a few bucks, but you’ll learn some valuable lessons.

And as a bonus, start thinking about protecting your wealth from all the scammers that are working day and night to separate us from our money. I have a whole bunch of posts here.