In the post on Asset Allocation and in about 50 other posts, I advocate for having a fixed income position. Sounds good, right? But what does that mean and how do we go about it? And how much is too much?

Good questions. Today we’ll talk about what exactly fixed income is, why we need it and how much we should have.

Assets

Whether we know it or not, we all have assets. We own stuff. Have something that’s worth some money; what you’ve got there is an asset.

As we become adults (some of us) we start to accumulate more assets. I have a garage full of assets.

We’re not going to talk about those assets today, but we are going to talk about the assets that we own that we consider investments.

An investment is something we buy that we expect will be worth more in the future. That’s it. Pretty simple.

As we start accumulating investments, it can help to categorize them so that we know what we’ve got and we can talk about fun things like Asset Allocation.

Asset Allocation

Asset Allocation sounds hard but it really isn’t. And it’s more of an art than a science. Which is nice because there is no right answer – which also means there is no wrong answer, which to me means that it is OK (and not life-threatening) to experiment a little.

I like to think of asset allocation as the process of deciding how much of my investments I want to have divided into 3 broad categories: Cash, Fixed Income and Equity.

In order to understand the role of fixed income, we’ll talk a little about the other 2 as well.

Cash

We all know what that is. Pull out your wallet. That’s cash.

Cash is comforting. I have a $20 bill in my wallet. I can buy $20 worth of stuff. I also know that I can use that $20 next week, next month or next year and buy $20 worth of stuff.

I can put cash into a savings account and I’ll get a little bit of interest as well. It won’t make me rich, but it’s something.

Cash is good to have for upcoming expenses like paying my monthly bills, and for having an emergency fund to cover the unexpected.

Cash has proven not to be a good investment because of its historically low rate of return as compared to equity and fixed income.

And cash can also lose out to inflation. Inflation averages about 2.8% per year. Some years it is more, some less, but the historical average is about 2.8%. That means even though my $20 bill will still be a $20 bill a year from now, stuff will be more expensive so I won’t be able to buy as much stuff.

Utilizing high-yield savings accounts and other cash products will help us keep up with inflation, but our cash assets aren’t going to grow much.

Also, most cash accounts – bank savings and checking or high yield savings – are FDIC insured which means that if our financial institution fails, the FDIC will guarantee our deposits up to $250,000. Which is nice.

Equity

Equity means ownership.

We can have an equity stake in our home. If we own a home worth $500,000 and we owe $400,000 on our mortgage, our equity (ownership) in the home is $100,000. That’s what we own. The bank owns the rest. That’s their equity.

But in the investing world, equities typically refer to shares of publicly traded companies, or shares of mutual funds that hold publicly traded companies.

I say typically, because there are things like private equity and complex equity products that can be corporations set up to own real estate, classic cars, or other real property, but we’ll stick with the more common public companies for today.

Any one of us can go out to a broker like Fidelity or Robinhood, open an account, put some money in and buy a share of McDonalds. We love hamburgers and they always have a line at the drive-thru so why not?

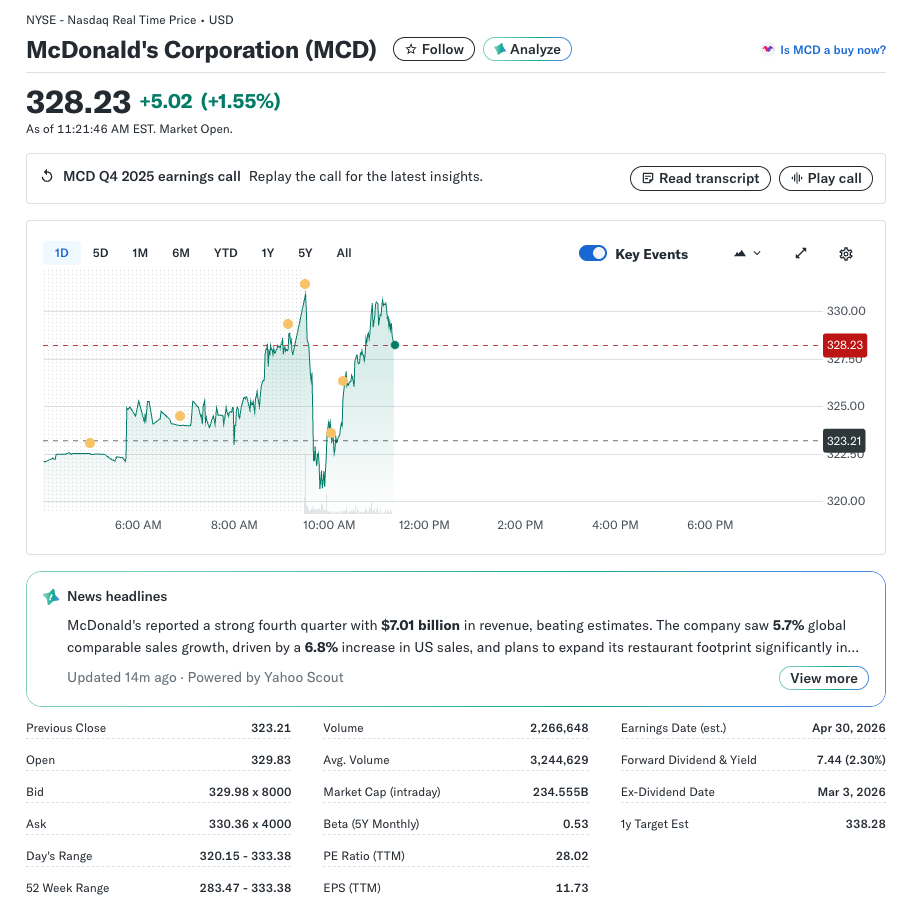

Here’s what Yahoo Finance has to tell us about McDonalds.

For the low low price of $328.23, we can own one share of McDonalds.

While we can’t go into the nearest restaurant and start bossing people around, we are now an owner.

McDonalds has 712.15 million shares outstanding. So with our 1 share, we own 1 / 712,150,000 of McDonalds. Not a lot.

But our ownership allows us to participate in profits. McDonalds pays a $7.44 annual dividend. A dividend is a payment made to shareholders from the profits that a company makes. We’re a shareholder so we’ll get a payment.

The $7.44 dividend is roughly a 2.30% return on the $328.23 that we paid for our share. That alone beats what we’d get in our Bank of America savings account.

But there’s more…Every year McDonalds opens more stores. Each store becomes a little more profitable. The company earns more money, which means investors are willing to pay more for a share, so the share price goes up.

If I look back at the 5 year chart for McDonalds, it’s been a bumpy ride with lots of ups and downs, but if I bought my share 5 years ago, I’d be up quite a bit.

Equity Risk

While McDonald’s stock price has gone up over the past 5 years, this isn’t always the case. Some companies will grow, others will hit upon bad times or make some bad decisions and they’re price will decline.

And since we can’t predict the future, we don’t know which companies to buy. This is why we need to diversify (basically not put all of our eggs in one basket). A mutual fund or Exchange Traded Fund (ETF) is a great way to diversify.

Fixed Income

It’s about time, right.

Fixed income falls in that sweet spot between the historically higher returns of equities, and the dependability but low returns of cash.

Fixed income is appropriately named, because it is an asset that provides the owner a fixed income stream. Since that is unhelpful, let’s look at an example.

But first a little background.

When a company or a branch of government needs to raise money, one of the ways that they can do this is to issue a bond, which is a very common type of fixed income instrument. For today’s discussion we’ll stick with bonds when discussing fixed income.

Bond Example

Most of us are familiar with a little company called Microsoft. If we’ve ever used Word, Excel or the Windows operating system, we know Microsoft.

Microsoft is a huge company and it generates a ton of revenue but, like all companies, it finds itself in a position where it needs some cash from time to time.

One of the ways that Microsoft can generate some cash is by selling a fixed income instrument called a bond.

Let’s take a look at one of Microsoft’s bond offerings.

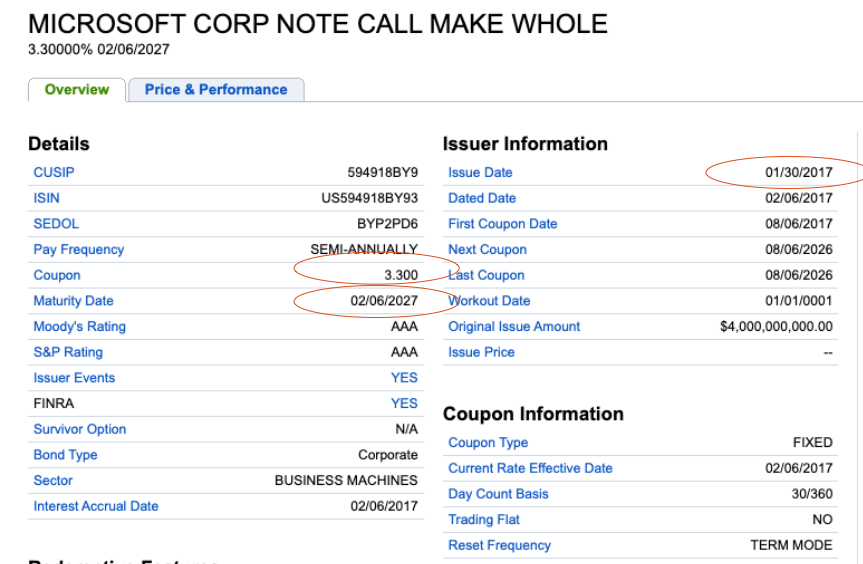

- Issue Date – Microsoft issued this bond on 1/30/2017

- Maturity Date – on 2/6/27, this bond matures. At that time, all bond-holders receive their original investment back.

- Coupon – Coupon is the annual rate of return. Holders of these bonds will get a 3.3% annual return for the life of the bond

- Face Value – not shown here, but the face value of a bond is typically $1,000. It will cost me $1,000 to buy 1 of these bonds. If I want to invest $100,000, I’d buy 100 bonds. The issue amount (that Microsoft is looking to raise) is $4billion so there are plenty of bonds to go around.

So let’s say we bought this bond when it was issued in 2017. We pay $1,000 and we get our bond.

Every year, we will receive 3.3% of our investment, or $33 in interest payments. The first payment is on 8/6/2017, and we’ll get 2 payments per year (because the bond pays semi-annually) of $16.50 each.

On the maturity date of 2/6/2027, we’ll get our $1,000.

Loan

You’ve probably figured out by now that by buying a bond, we’ve essentially loaned Microsoft $1,000.

Microsoft needs money to fund its business ventures and it offers a bond so that the investment community can lend it money.

The bond specifies the terms of the contract. It says when payments start, when they end, the interest rate we’ll receive, and when our initial investment will be returned.

It’s just like our car or home loan, just in reverse. Now we’re the ones loaning the money. How cool is that?

Income Stream

And for the privilege of borrowing our money, the bond-issuer pays us interest. And if we’ve got lots of bonds, bond funds and ETFs, we’ll generate a nice little income stream.

Fixed Income Risks

Just like with equities, there are risks associated with being a bond-holder.

The first risk we need to be aware of is default risk. This whole thing works out nicely as long as Microsoft makes its semi-annual payments to us, and as long as it has enough money at maturity to pay back all bond-holders.

If Microsoft fell on hard times, it might be forced to miss a payment or 2. Or worse yet, it may not be able to repay our full bond purchase amount at maturity.

Microsoft is a pretty dependable company, but when we buy bonds from less-well-financed companies, we run the risk that the company could default.

Time is also a risk. We may feel pretty good about Microsoft’s prospects in the next year, but how about 20 years? That’s more uncertain.

As an investor, we’ll receive a higher rate of return for a longer duration investment because the risk is higher.

Why Do I Want Fixed Income?

Earlier I said that equities, as a group, have historically outperformed fixed income. If this is the case, why own fixed income?

2 reasons.

- Volatility – Does your stomach lurch when the S&P 500 is down 5% in a day? How about when it is down 10% for the year? Yup, mine too. Bonds tend to be a lot less volatile. Having bond funds in our portfolio can help to even out some of the huge swings that equities are subject to.

- Income – When we’re 20 and we’re saving for retirement, we may not need this, but when we’re 65 and the paychecks are no longer coming in every week, bonds and bond funds can provide a dependable income stream to help supplement social security and help us pay our bills.

How Much?

100% is probably too much, and none is likely not enough.

But this depends on our personal financial situation, and our risk tolerance.

Financial Situation

I like to make sure that money I need in the next 5 years or so is pretty safe. That money is not invested in equities. It’s in cash and fixed income.

Beyond 5 years, I evaluate my financial situation. I’m 62 and could live to 92. In order to pay my bills 30 years from now, I need some money in equities for higher growth potential.

But today, I could use an income stream as well so I’ll tend to have more bonds and bond funds at 62 than I would at 25.

This is the process of asset allocation and there is no right answer. I want to be sure I have income but I also need to generate growth.

Risk Tolerance

I worked for investment companies and I know that the phones light up when the market tanks. It’s human nature. When our balance drops by 5% in a day, we panic.

Depending on each of our personal panic levels, we should assess our allocation. If I know that I can’t take a 5% drop in a day, maybe I should have a higher % in bonds. My portfolio will likely grow slower than an all-equity allocation, but I’ll have some peace of mind during a pull-back which will prevent me from selling at the worst possible time.

And that’s really the risk. We don’t want our emotions to cause us to sell at an inopportune time.

How Do I Get Started?

Buying individual bonds can be intimidating.

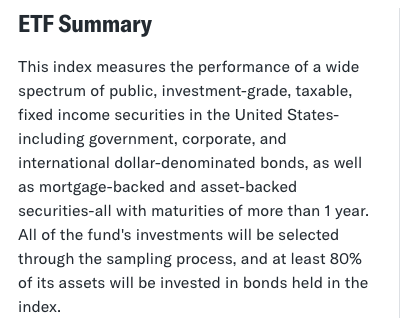

I tend to stick with bond funds, particularly bond index funds. Just as we have the S&P 500, which is a stock index, there are many different bond indexes. And each bond index fund tracks a particular index.

So, we could buy shares of an ETF like the Vanguard Total Bond Market Index Fund (BND). According to Vanguard:

This is a pretty well-diversified choice and it pays a 3.85% annual yield which ain’t bad.

Wrap Up

Fixed income provides us an income stream and some protection from volatility.

Depending on where we are in our investing journey, we may want more fixed income or less. The process of making this decision is called asset allocation.

And there is no right answer. Our job as investors is to develop a strategy that grows our wealth while letting us sleep soundly at night.