I’ve talked about inflation in a number of posts, but we’ve never really gone into what inflation is, what causes it and why it’s so difficult to correct, and most importantly, what can we do about it. I’ve done a bit of reading this morning to try and get a better understanding myself so I thought I’d pass on what I’ve learned.

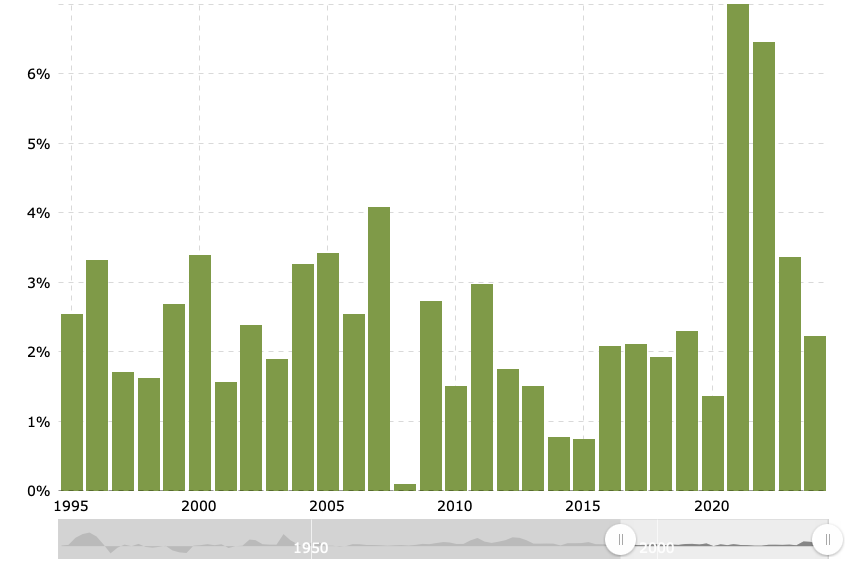

Inflation Over the Years

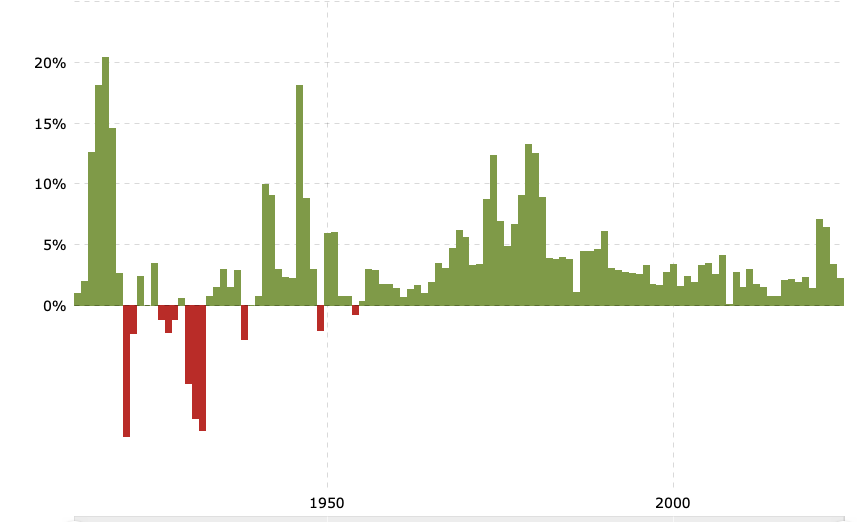

Inflation has been particularly painful in the last few years, but inflation has been with us much longer than that. Let’s take a look at inflation over the years from data compiled by the US Bureau of Labor Statistics (BLS) and presented by macrotrends.

Use the macrotrends link to look at the entire history. You can see deflation during the great depression, super high inflation during 1979, and other anomalies, but in general, inflation is about 2.5% per year every year.

What is Inflation?

That’s an easy one…it’s prices going up. We know it when we see it.

Inflation has been high for a couple of years. I remember 2 years ago we built a deck and lumber prices were through the roof. They came back a bit and then we couldn’t afford eggs. Then bacon prices were crazy – forget having breakfast on the new deck.

Inflation is an increase in prices, but what exasctly does that mean and how is it measured?

The Bureau of Labor Statistics (BLS) & the Consumer Price Index (CPI)

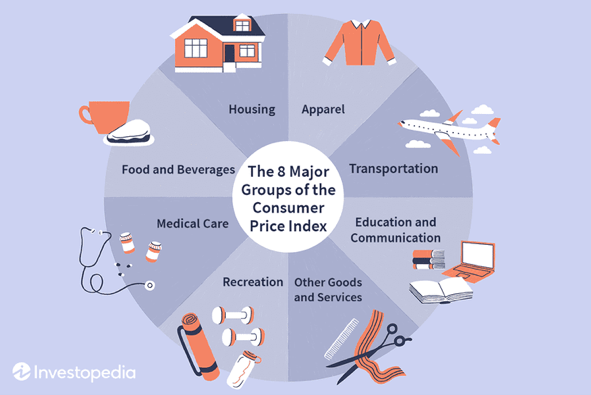

The BLS is a US government agency. Learn more at bls.gov. One of the jobs of the BLS is to publish the Consumer Price Index (CPI). More about CPI here.

According to the BLS, the Consumer Price Index (CPI) is a measure of the average change overtime in the prices paid by urban consumers for a market basket of consumer goods and services.

The BLS goes into great detail to describe how a particular cheese is chosen to represent the price of cheese in general and how the price change is measured. Clearly they are quite proud of their work and you can visit their site to learn how the sausage is made, but I prefer the executive overview from investopdia.com. “The CPI is based on about 80,000 price quotes collected monthly from some 23,000 retail and service establishments as well as 50,000 rental housing units.”

Here’s a picture of the expense groups accounted for in CPI

CPI is typically reported as either an annual or monthly figure. It is the change in price of those 80,000 items, expressed as a percentage, between the start of the period and the end of the period.

If we say that inflation increased year over year in April by 3.4%, we’re saying that if I bought those same 80,000 items in April 2024, I would spend 3.4% more than I would have in April 2023.

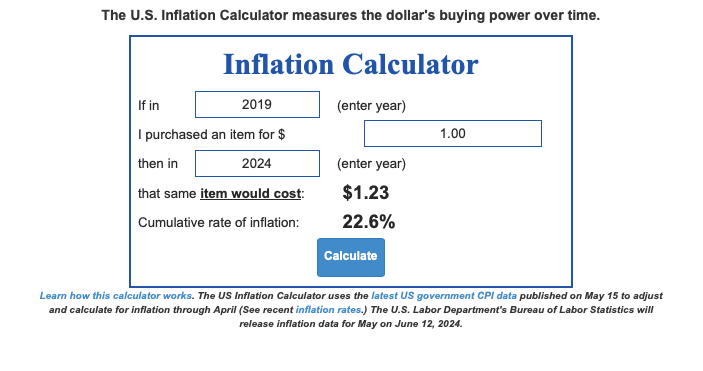

Here’s a neat calculator to visualize the impact of inflation.

What Causes Inflation?

There are 3 key factors that influence inflation.

- Production costs – when the price of wages and raw materials increase, this causes an increase in the price to produce finished goods. This price is passed on to consumers.

- Demand – Strong demand for products and services will cause prices to increase. To impact inflation this needs to be a broad and sustained demand increase. Just because Taylor Swift tickets are hot right now, doesn’t mean that Ms. Swift is the cause of inflation.

- Fiscal Policy – government spending impacts inflation. Tax cuts, incentives and government spending all put more money into the economy which causes consumers to purchase more goods, which creates demand and drives prices up.

We’ve hit the trifecta. We have all 3.

Production Costs

Fuel costs are high so it costs more for the energy to build things, it costs more to heat the buildings where things are built and it costs more to transport them. Also, many workers are getting paid more. Check out the news on unionization and increasing minimum wages. I don’t take a political side on these arguments, but as a capitalist, I realize that they add to production costs.

Demand

Unemployment is low, which stimulates demand. People have money. This is a little lopsided according to an article I read yesterday. Boomers have lots of money and are spending while younger generations have less to spend. Though that doesn’t completely align with a story from today where demand at Footlocker is recovering and Chipotle, Booking.com and several other consumer-centric companies are seeing sales growth. Hard to pin down, but demand overall remains strong.

Fiscal Policy

Fiscal policy is a conundrum. The Federal Reserve has had quite a few rate hikes. By raising interest rates, it is harder to access capital and this, over time, slows down spending. It is imprecise but it is the only tool we have to counter inflation.

On the other side of the federal government, we are spending like drunken sailors. The Congressional Budget Office now recognizes that the Inflation Reduction Act does not reduce inflation. It increases spending which puts more money into the economy.

I love the $8,000 tax credit I got in 2023 for adding solar panels – thank you. I also applaud the infrastructure spending. Route 20 near me is a mess. Today they were digging up and repaving a huge stretch.

This is great stuff, but the timing is not ideal. I’m not sure how to balance the numbers, but it seems like the government is adding more money with its various stimulus programs than it is talking out with its rate raising.

Isn’t Inflation Going Down?

No, No, No

The media’s reporting of this is confusing. I’ve seen headlines that inflation is decreasing. While technically not untrue, I would try to be more precise and say that inflation is still continuing to rise, but the rate at which it is rising has slowed somewhat. My version is not very catchy. This may be why I can count my number of readers on one hand while the mainstream media has millions of readers.

Inflation last month was up 3.4% from last year. That means that if you spent $5,000 per month on living expenses, you are now spending $5,170. That’s an extra 170 per month or over $2,000 per year. Look back at the compounding article and the Al & Peg story. $2,000 per year made them a fortune.

Inflation is Killing Us

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” This is a quote by Ronald Regan. Our National Debt is exploding. Credit card debt and defaults are rising. We have fewer dollars for saving after the increased prices we pay for EVERYTHING.

What Can We Do?

Here’s another quote. “If you put the federal government in charge of the Sahara Desert, in 5 years, there would be a shortage of sand.” Milton Friedman

So waiting for the government to fix this may not be our best course of action.

Following the steps we talk about here at finance-abcs.com work in inflationary times, it’s just a bit harder.

- Save. Read the post for some tips. It may not be as hard as you think.

- Create a budget. We need to proactively decide where every dime is going to go. Especially when money is scarce, we need to maximize the value of what we have.

- Build an emergency fund. Start small and add to it regularly. Don’t let a major expense derail your plans.

- Invest. We all need to invest. We have lots of posts to get you started. While inflation brings higher interest rates, those rates are still not providing the growth we need to counteract the prices of EVERYTHING going up. I can’t guarantee that you will come out ahead in the next 1,2,3 or even 5 years. Don’t invest money you’ll need in the next 5 years, but find a way to put aside a few dollars and invest. History shows that this is a dependable method of building wealth which will counteract the effects of inflation.

Recap

Inflation is pretty common, however, the spike over the last 2 years is not common and has been hugely impactful. While it helps to understand inflation, I learned quite a bit from my reading today, we also need to take action to offset the impacts of inflation while continuing to grow our wealth.

The steps above, as well as some of the linked posts can help with these actions.

Good luck!

👍