This morning, I was reading about tariffs and the national debt. I wanted to understand more about how tariffs could help the US pay off some of our debt. If other countries are paying us tariffs, presumably that is a huge amount of money that could be put toward our $37 trillion debt.

I’ll spare you the details of what I read, but it is possible that the tariff proceeds could help with this.

But in my reading, I again came across quite a bit of discussion about how our “entitlement” programs – namely, social security and medicare are both expected to run out of money.

I’ve written a bit about this. It doesn’t necessarily mean that payments will stop, but without intervention, payments would likely be decreased.

Intervention

I have little hope for intervention.

Our national debt is growing exponentially, and we haven’t seemed to be able to find a way to slow the growth. In fact, we seem to find other ways to spend more money and create more debt. This is true of republicans and democrats alike. US voters want a lot of stuff, and politicians don’t seem to want to say no.

This is problematic. I don’t think that we’ll have the capital to shore-up these programs without finding a way to manage our expenses and start paying down some of that debt.

I’m not optimistic about our government’s ability to divert funding to social security and medicare.

But, let’s be optimistic and assume that we find a way to make these programs continue as planned for the foreseeable future.

I’m Worried About People’s Retirement Finances

Let’s do some quick math.

The Motley Fool tells us that an American household’s average monthly expense is $6,440 per month or $77,280 per year.

Bankrate tells us that the average retiree receives $1,980 in social security benefits.

If the average household spends $6,440 per month and will receive $1,980 in social security once retired, it seems like we’ll have a shortfall of $4,460.

That’s OK, we don’t expect people to live off of social security. In the old days we had a pension to supplement our income in retirement, today many of us have a workplace 401k.

How Much Savings Do We Need to Have in Order to Generate $4,460?

Our monthly $4,460 shortfall is an annual shortfall of $53,520.

Many financial professionals use the 4% rule when advising clients how much they can spend in retirement. Simply put, the rule says that in your first year of retirement, we can take 4% of our nest egg in cash to cover expenses. We can then adjust that amount up by the inflation rate each year and it should last us 20 years or so.

So, if I have $1.35 million in my 401k, I can cover the $53,520 shortfall (4% X 1,350,000 = 54,000).

That’s cool. As long as I have $1.35 million socked away, I should be able to retire at 65 and fund my spending through my 85th birthday.

But, let’s adjust a bit. Is that household spending figure accurate for a retiree?

Don’t We Spend Less In Retirement?

Yes and No.

I have not found that to be the case yet. I am 61 (62 next week!) and I’ve been retired for 5 years. I spend about the same now as I did before I retired.

My wife and I are pretty good savers – we don’t take extravagant trips, we don’t have expensive hobbies, but we do spend more on recreation since we are home all week.

Though I suspect this ramps down as we age. I don’t imagine we’ll be taking vacation trips when we’re 80. It would be cool if we were healthy enough to want to, but I’m guessing we slow down.

Per Investopedia, the average retiree spends $5,000 per month.

Updated Math

So, If I spend $5,000 per month in retirement, that’s $60,000 per year. With an average social security payment of $1,980, my shortfall is $3,020 per month or $36,240 per year. That’s better.

Using the 4% rule, I can cover that with $900,000 in my 401k at retirement.

Median 401k Balance

Reading ahead in the Investopedia article, the median 401k balance is $210,724. Using the 4% rule, I can take about $8,000 per year or $666 per month.

My spending will be about $5,000, and my social security plus my 401k withdrawal only come to about $2,500. That’s a pretty big shortfall.

What Can We Do?

We have a problem.

All of us.

If you’re reading this and thinking you’ll be eating cat food in retirement, you’re not alone. This is a brewing problem in the US. The difficult part is that the US budget is strained and the government’s ability to step in and help is limited.

Worrying won’t help, but there are things we can do.

Time

For those who are young and have years to save, you are in a great position to achieve a goal of saving $900,000 for retirement.

The key is to put as much as you can into your retirement account and invest in low-cost equity mutual funds. I’m partial to a low-cost S&P 500 fund.

Compounding

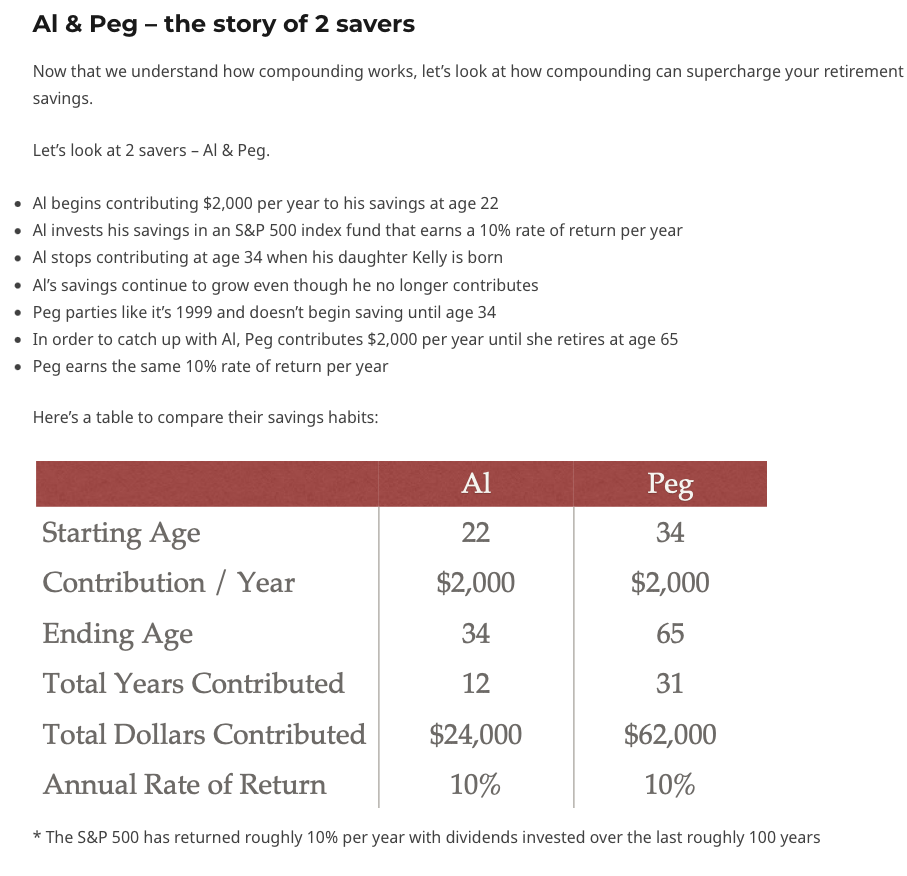

In one of my first posts, I told the story of 2 investors – Al & Peg and how their savings grew. The point was that because Al started early, he was able to contribute less, but time made his ending balance double what Peg’s was. Here’s what happened.

For those who have time, a $900,000 savings goal is not outside the realm of possibilities.

No Time

Then there are those of us who don’t have time on our side.

Let’s say I’m 65 and I have the median amount of $210,000 saved in my 401k.

Financial professionals will tell us we can work longer or find ways to make additional income, but I have friends who have been forced out of a job, or have been having a tough time finding something at 55+ years old.

But making additional income is not always about finding a traditional job. I’ve just gone through several posts and some reader debate about owning income property. Several readers have been successful with this. Read more here and here.

I also wrote in my Friday post this week about income investments. Income investments could be stocks, bonds, mutual funds, CDs, treasuries or high-yield savings accounts. The income that these investments produce can help us bridge the income/spending gap.

A high yield savings account is safe, but it is not going to provide any capital appreciation. At this point, we would most likely be looking for a portfolio of investments that will be likely to grow in value, and will pay us a dividend or interest along the way.

T. Rowe Price was the stock example I used in the Friday post. It pays more than 5% as an annual dividend and has the potential for growth. T. Rowe is one of over 30 dividend paying stocks in my portfolio.

While you may not be able to find a new job in your field at 65 years old, there is no reason that you can’t spend some time to learn about investing and start to diversify your portfolio into income producing investments.

There is risk associated with this, but there is also the risk that our current 401k balance will run out before we do.

Wrap-Up

I’m worried.

Our 401k balances are too small. Our government has not demonstrated an ability to manage its growing debt so it is unlikely to be able to help us solve this problem.

It’s up to us.

Quick editorial comment…this is not entirely our fault. My generation is the first generation to be largely required to self-fund retirement. My grandparents generation didn’t tend to live much beyond 65. They typically worked til they died. My parent’s generation lived longer, but they had a pension. We’re the first generation to have to plan for our retirement spending, and we’re living longer to boot. Oh yeah, and no one really taught us how to do this.

The good news is there are things we can do.

Saving more is a great 1st step for anyone at any age. I like finding ways to save that don’t cause me to deprive myself. Read more here.

We then need to put that savings to work. The magic of compounding and the historical wealth building track record of the S&P 500 make this fairly simple.

And for those who don’t have the time to watch their wealth grow over many years, income producing investments – whether it’s real estate, a real estate fund, dividend paying stocks or bonds, can help us make up our spending shortfall. We’ll likely need to study a bit and learn some new skills before we jump in, but there is no reason we can’t be successful.