For all my friends who are either close to, or in retirement, this is a common topic of discussion. While social security alone will not likely be enough to fund our retirement, the monthly check from the government may be an important piece of our retirement strategy.

What is Social Security?

The US government instituted the Social Security Act in 1935. Along with unemployment benefits and aid to dependent children, the act included Old Age Survivors and Disability Insurance, also known as social security. Read more here.

Social Security works much like a nationwide defined benefit pension plan in that participants get a monthly payment upon retiring. The payment continues until death. Recipients can choose to take the payment as early as 62, or hold off until 70. Every year you delay, your benefit grows.

Who is Eligible?

However, unlike a defined benefit retirement plan, participants actually pay into social security. We do this through payroll taxes.

If I pull out my Paystub, I see a line item called OASDI under taxes. This is our old friend Old Age Survivors and Disability Insurance from above. Unless you work in certain government positions (usually because they have their own pension plans), you will pay social security tax. In general, if you pay social security tax for 10 years, you will be eligible for some amount of social security benefit.

My mom was a teacher and she has a Massachusetts state pension. She did not pay social security tax and she gets no social security benefits.

How Much?

I apologize, I’ve been purposefully vague in specifics about benefits and payments because it is somewhat complicated, and it is based on each person’s specific work history and age. The good news is that you can find out all the specifics of your personal situation by logging into ssa.gov. If you’ve not done so already, create an account and log in. It will take less than 5 minutes.

On ssa.gov, you will see the details of:

- Your work credits. You earn work credits for every year you work based on your salary. While working for 10 years generally gets you benefits, actual eligibility is based on credits.

- Your earnings record. See every year you worked and the salary you received.

- And most importantly, a graph that shows your personal estimated benefit at every year from age 62 through age 70.

When Should I Take Social Security?

For those of us born after 1960, Full retirement age is 67 years old. At that age, we get 100% of our benefit. But we have choices on when we start receiving our benefit.

We could choose to take our benefit early and start collecting at 62 and get roughly 70% of our full benefit amount, or we could hold off until age 70 and get 116%. Or we could pick an age in between. ssa.gov will let you see the estimated payment amount for each scenario.

Quick Sidebar

It’s kinda funny that social security is called Old Age Survivors and Disability Insurance. In 1935, when social security was established, life expectancy was 61.7. I’m sure no one at that time expected to be paying benefits into people’s 80’s, 90’s or even 100’s. In my opinion, this is why social security is often considered to be “at-risk”. While OASDI payroll taxes can increase, it’s a challenge to plan to pay benefits for 20 or 30 years. This is the same problem defined benefits pension plans have and why there are so few around today.

When?

…And we’re back. So what’s the right age? Before we can decide, we need to answer a few questions. And while some are impossible to answer right now, we at least need to think through them.

Questions

- When am I going to die? Ha Ha. Most of us don’t know. But we may have some indications. My dad passed away at 76. He was managing some heart issues (he had a pacemaker) he had diabetes which he was managing through diet, and he had both prostate and skin cancer. A trifecta of major health issues. My mom is 86 and has Alzheimers. I’m 60 and healthy today, but if I were to bet, I’d guess shorter rather than longer. There are no right answers here, but it’s input to a decision.

- When do I need money? Yes, I’d like some please…dumb question. If I can hold off until 70, I’ll get a bigger paycheck from social security. I don’t want to eat catfood today to hold out for a larger paycheck in the future, but if I can last a few more years at my job, or become a Walmart greeter part time for a few years, it may be worth my while.

- Will social security still be around? There is a lot of talk about this, but this is a government controlled program and there is always a risk that it may change or be eliminated. Read the post on the national debt. In my opinion, our elected officials are not doing a stellar job managing the country’s finances. Debt is higher than it has ever been and going up every minute. See the debt clock here. Looming government shut-downs are a regular occurrence because we can’t get a budget done. Are our elected officials likely to solve our financial problems, when they can’t solve their own?

- What if I took it at 62 and invested? Assuming you’re retired and you can live off of other savings for a few years, you could potentially take your social security at 62, invest each paycheck in a nice low-cost S&P 500 fund, and you may end up with more than if you waited for 70. We’ll look more at this in an upcoming post.

Create a Spreadsheet

All good financial decisions begin with a spreadsheet.

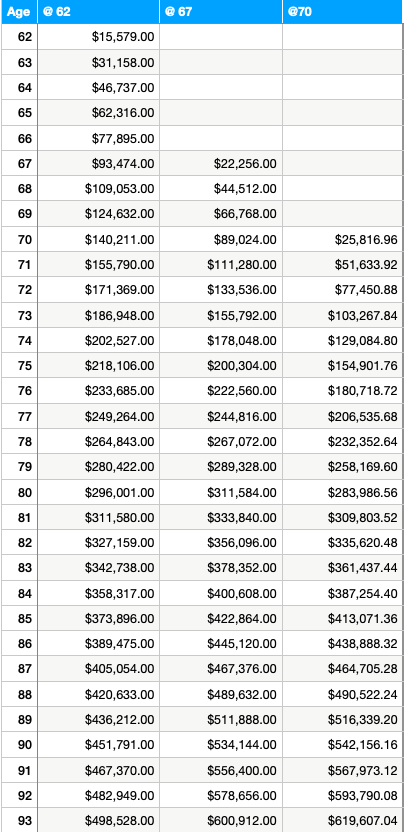

Below, I’ve taken the average social security benefit of $15,579 per year at age 62 and projected out how much I’d receive over time if I took it at 62, or 67 or 70.

The column on the left is my age. @62 shows the cumulative benefit payment. The first year I get the $15,579, the 2nd year I get another $15,579 and so on, there is no investing and I’m assuming I”m spending the entire benefit, I’m just keeping track of the total benefit received.

The @67 column shows me taking 100% of my benefit – a higher amount of $22,256 each year. The @70 shows the even higher amount at age 70.

Interesting

Study the chart and a few interesting things pop out.

If I start taking at 62 instead of 70, I will have received $124,632 before I would have even started to receive a benefit had I waited.

I need to live until I’m 81 to have the waiting til 70 strategy work in my favor. Up until that point, taking the smaller amount at 62 gets me more dollars in benefits.

If I live to 93, I will have gotten significantly more by waiting until 70. Interestingly, taking the benefit at 67 and taking at 70 are about equal at age 93.

Wrap-Up

There is no secret code to calculating the right age for beginning social security payments. It’s structured as it is – with lower payments early on, and higher payments for waiting, to balance the government’s risk of how long they’ll need to pay.

To come up with the best number for you, think through the 4 questions and come up with your own spreadsheet.

For me, given my parent’s health history, and my lack of faith in our elected officials, I’m taking my first payment at 62.

Let me know what you think.

Nice blog, Rosco.

It would be interesting for you to add some columns to your spreadsheet for a few scenarios.

If you retire at 62 but don’t take SS until 67, what’s the hit to your 401K on the delta you need to withdraw? For example, if you need $50K per year you would need to pull all that out of your 401K for 5 years instead of just $34,421.

Alternately, show the accrued growth of taking SS and investing it.

Compare both of these to 67 and 70.

It seems a toss up.

Thanks for reading and thanks for the comment. I’ll post a follow-up shortly to address your question in more detail. It does seem like a toss up but it would be interesting to project out a few different scenarios. Let me think about it for a few days and I’ll post some details.

Check out the follow-up post here: https://finance-abcs.com/social-security-now-or-wait-a-follow-up/

I read the follow and found it illustrious. Thank you.

Awesome – thanks.