It’s not uncommon during earnings season to see our growth stocks move 20% in a day. Expectations are high for 20% plus earnings growth, but more importantly, we want to hear optimism from management that the growth will continue.

If either of these wobbles, we could be down big, or up big. That’s how earnings season works.

But what is happening on a Tuesday morning, with no real excitement on CNBC and all of a sudden a stock that tends to be pretty stable is down big? We go hunting for news on the company, the sector or the economy. Nothing. So what do we do??

Supply and Demand

So let’s do a quick refresher in how stocks trade.

While it used to happen in a pit on wall street with traders screaming prices at one another, it is now mostly automated, and it all hapens on an exchange like the New York Stock Exchange (NYSE) or the National Association of Securities Dealers Automated Quotes (NASDAQ).

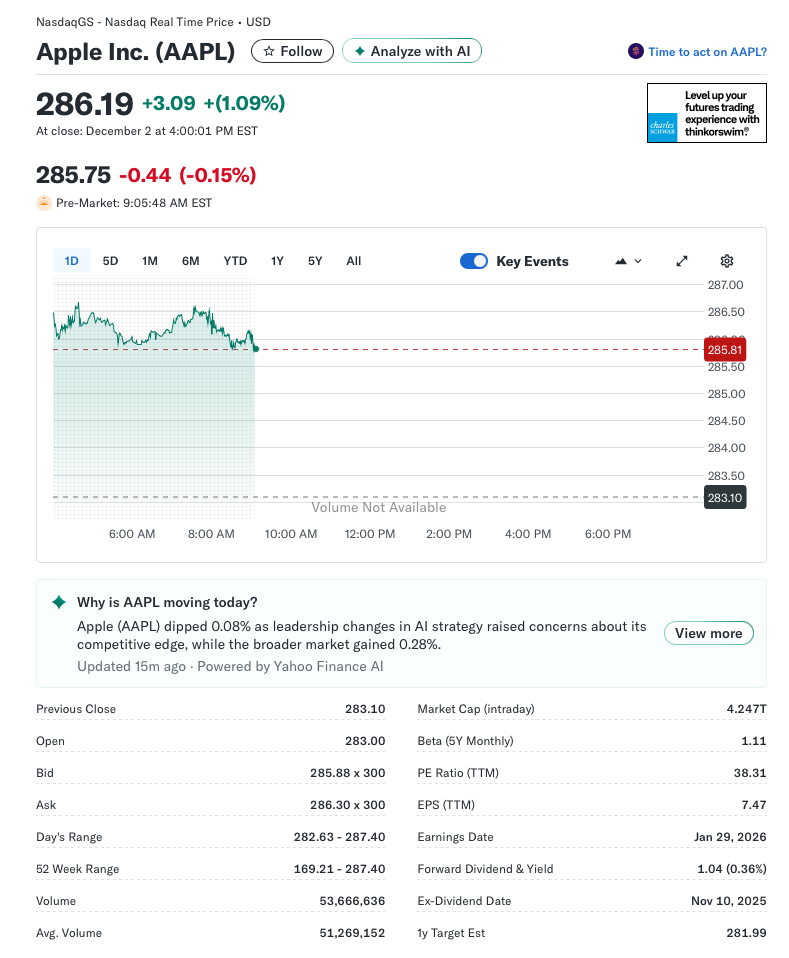

In order for a trade to happen, someone needs to offer some shares for sale. If no one’s offering, no one’s trading. Let’s say I’m offering 100 shares of Apple at $285.

The market hasn’t opened yet, Apple looks like it will be down at open based on the pre-market price, and I need the cash so I’m putting in a offer price below the current best offer and even below the bid of $285.88.

I’m hoping this sells at open.

Look at the average volume. Apple trades over 50 million shares every day. I’m selling 100.

Who’s Trading?

- Computers (on behalf of trading firms)

- Mutual Funds and Institutions

- Us

I’m trading 100 shares today. the other guys are trading the remaining 50 million shares. And they’re doing it every day.

Mutual Funds

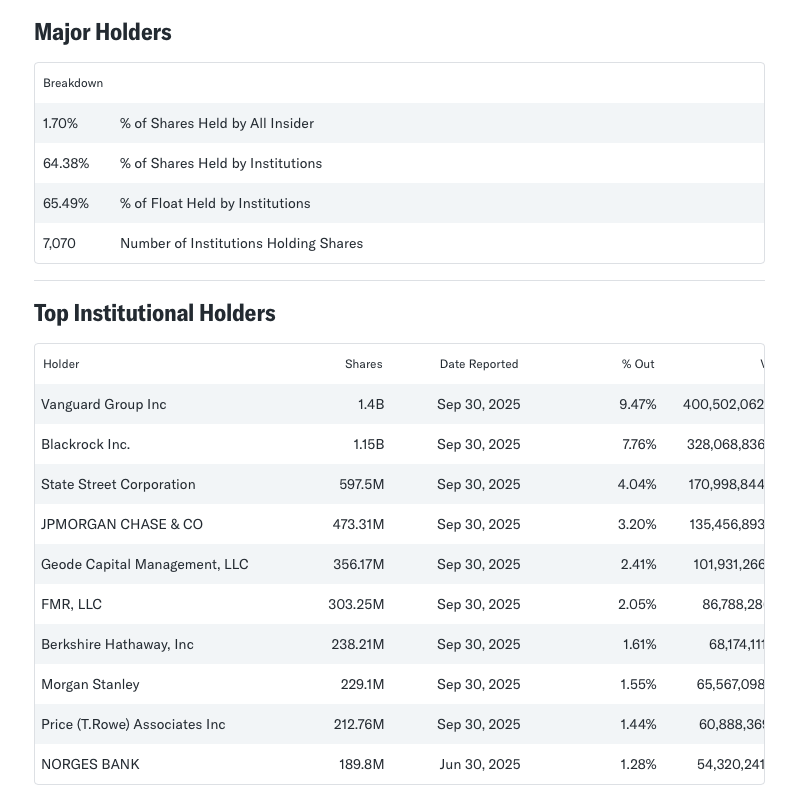

First, let’s take a look at who owns shares of Apple.

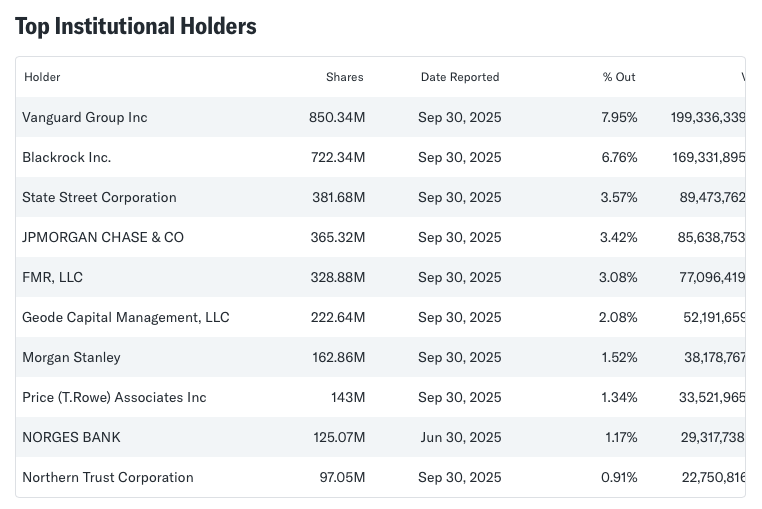

Look at any large-cap growth stock like Apple, and you’ll see roughly this same cast of characters. Here’s Amazon’s top holders.

These firms are all holding shares of Apple and Amazon in their mutual funds and ETFs, and other pooled investments.

I have a couple of hundred shares of Apple. The Vanguard Group has 400 million shares. At $285 per share, that’s a lot of Apple.

Analysts

Like any good mutual fund company, Vanguard has a team of highly trained industry experts that work as research analysts.

Because Vanguard owns almost 10% of Apple stock, the Apple team (CFO and other senior execs) will come visit Vanguard and talk about their business and growth opportunities.

Apple wants to keep big shareholders happy and it also wants to influence how Vanguard votes its shares at company meetings.

This second part is a big deal. If Apple wants a new pay package for Mr. Cook, it’s important for them to rally support with Vanguard, Blackrock, State Street and Fidelity in advance. It’s worth putting some execs on a plane to do this.

And while they’re in town, they’ll have a Vanguard analyst day. The Vanguard analysts that cover the tech industry and advise the portfolio managers will meet with Apple execs and ask lots of hard questions.

The analysts end the day with their questions answered and a new opinion of Apple. Think how much better investors we would be if the Apple executive team stopped by our house to update us on growth plans?

Sell

Let’s say the analyst leave with some skepticism about Apple’s ability to grow – I mean, how long can this iPhone thing really keep going? They sold 232 million iPhones in 2024, but who can keep that up?

So our analysts update their notes and move Apple from a buy to a sell.

This has absolutely no effect on Vanguard’s index funds because they buy and hold what the index holds. But active fund managers trade on the advice of research analysts. A drastic downgrade of Apple means Vanguard fund managers will start selling some of their 400 million shares.

Moving the Market

Not surprisingly, my trade processes at $285 per share for 100 shares. When the market opens, someone sees this as a good deal and buys my shares.

This has absolutely no impact on the price of Apple. There are 50 million more shares left to trade today.

But, after the nice Apple execs leave the Vanguard office, the analyst downgrade goes out and Vanguard portfolio managers start selling shares of Apple.

They’re not selling 100 shares like me. They decide to sell 1/4 of the firm’s holdings, or 100 million shares.

Traders

Just as Mutual Fund companies have research analyst teams, they also have trading teams.

This Apple example is exactly why.

Once other traders see one firm intending to sell 100 million shares (that’s more than 2 day’s trading volume), they’ll think someone knows something and they’ll sell as well. This will become a huge spiral and the Apple stock price will get hammered. This would be bad for Vanguard, who wants to sell at the highest price possible.

So Vanguard’s mutual fund traders will start calling around (yup, using an actual phone) to brokers that they know who usually move large blocks of Apple shares. “Would you be interested in taking some Apple off of our hands? Great, how much?”

They’ll make lots of calls and work this over a few days, or even weeks so that they don’t tip their hand and cause panic selling.

But, as good as the traders are at this, it’s hard to hide the fact that a lot of selling is going on.

Price Drop

So inevitably, this leads to a big price drop. There is one big seller, but not enough buyers. And Vanguard is competing with every other seller out there, slowly dropping prices til they find a willing buyer.

Wrap Up

We won’t read about this anywhere. This is the normal course of business. A team of executives are visiting a major shareholder to provide updates on their business plans. This happens every day.

That shareholder was not impressed and decided to cut its holdings. Again, fairly common.

When large institutional shareholders decide to make a trade, they’re trading huge numbers of shares. And those volumes can have a significant impact on price.

Investors like us see that price movement and scratch our heads.

Does someone know something we don’t? Maybe.

Should we react? Unless our thesis has changed, probably not.

While the Apple example is extreme, and it’s unusual for a firm to dump 1/4 of its holdings of a particular company, mutual funds and institutions hold a huge % of just about every company that trades on the exchanges. And when they decide to buy or sell shares, those trades are likely to move the market and result in big short term moves for the stocks involved.

But since we’re investors and not traders, we shouldn’t be concerned.