See how happy these ladies are. It’s because they’ve invested in low-cost S&P 500 mutual funds.

Many folks are fearful of investing. The market is rigged. Only the big guys make money. Look what happened to my family in 2008. The first 2 reasons may be true. The 3rd is likely true and likely impacting our willingness to invest.

A brief flashback

I’ve read a bit about how economic meltdowns have impacted people. By my own experience, Y2K (remember the bug that was going to shut down the world!) employed boatloads of new tech workers. Companies were training non-technical employees to code. The nation’s COBOL army exploded to meet the need to combat the Y2K bug.

After Y2K happened, the layoffs started. The crisis was averted and now we had more programmers than we needed. These layoffs had a huge impact. I spent years working with local colleges and a couple of state agencies to try and entice kids to take technology courses. It was hard. They remembered the layoffs and the impact it had to their families, or friend’s families. Technology careers were too risky.

How is that relevant to investing?

Sorry for the flashback, but I use it to demonstrate a point. A similar thing happened in 2008. The financial crisis wiped out years, and even decades of savings for many folks. Many of us, myself included, found ourselves out of work, and with investment account balances that were 1/2 of what they were just a few short months ago, and we fled to cash. We locked in our losses. But what could we do, we saw our account balances dropping every day with no end in sight.

Many children who watched their families struggle through the 2008 financial crisis learned similar lessons to the children of 2000. Back then, technology careers weren’t safe. Now, it’s not safe to invest. The market is rigged. Only the big guys make money. Look what happened to my family in 2008.

You need to invest

2008 was bad, really bad. The market may be rigged and the big guys certainly make more money than the little guys. But we still need to invest. Let me show you why.

But first, while investing can be fraught with danger, mutual funds and ETFs are our friend. God bless people like Jack Bogle and Ned Johnson who made mutual funds available to the masses. Investing in funds and ETFs gives each of us an opportunity to own a basket of securities and participate in the market.

Let’s take a look at an example. The past 5 years have been uncertain times. COVID, Skyrocketing inflation, working from home, not working from home (and tying up all the tee-times during the week so us retirees can’t play golf) as well as some jaw-dropping pull-backs for the S&P 500. Not a comfortable time to be an investor!

What would have happened if we decided to take $1,000 each year for the past 5 years and put it in a low-cost S&P 500 ETF. Let’s take a look.

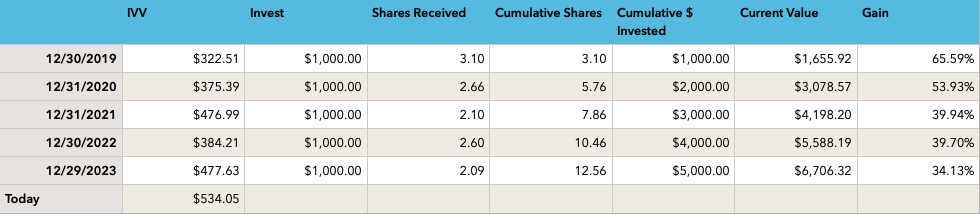

The column on the left is our investment date. We saved over the year and at the end of the year, we took our $1,000 savings and bought shares of IVV (iShares Core S&P 500 ETF).

Column 2 shows the price of IVV on the date in column 1.

Column 3 is the $1,000 we invested.

Column 4 is the shares we received for $1,000 at the price on the date in Column1.

The rest is pretty self explanatory. Current value is the value of the cumulative shares we hold at the time multiplied by the price today. That’s what our investment is worth.

How’d we do?

In total, we put in $5,000 and we now have $6,706. We have $1,706 more than we would have had if we’d stuffed the money under our mattress.

But we know better than to stick it under a mattress. We would have put it in a high yield savings account. Let’s take a look.

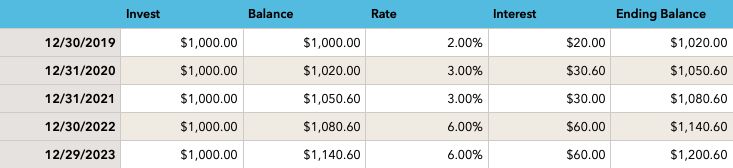

Same play. Each year we put in $1,000. I estimated the high yield savings rate and applied that to our balance. And because we know about compounding, each year we get interest on the prior year’s interest. Yay!

At the end of 5 years, we have $200.60 in interest. That’s pretty cool but it pales in comparison to the $1,706 gain we got in the low-cost S&P 500 fund.

Risk

The high yield savings account is virtually risk free. As long as our balance is under $250,000, the FDIC insures it in full. Even if our bank goes under, we get our money back.

The S&P 500 fund is not risk free. Look at the price on 12/30/22. It’s $384.21. A year earlier, the price had been $476.99. That’s almost a 20% drop. Ouch!! And then on 12/29/2023, the price of IVV is $477.63. That’s only $1 more than it was 2 years ago. 2 years of no growth, but over 5 years, we’re up 34%.

Dollar Cost Averaging

In 2022, when the price of IVV was down, we still bought shares. We received more shares for our $1,000 than we did the prior year. Dollar cost averaging is a strategy of regular investing that prevents us from buying all of our shares at a high-point in the market, and allows us to buy more shares for our money when the prices are low.

Time

Time heals all wounds. Especially in investing. On 12/31/2022, many of us were wounded as our portfolio values dropped by 20% in a year. In 2008, many of our portfolios dropped 50% or more.

In our example above, we had recovered by the end of 2023, and 2024 so far has been a good year.

In 2008, it took a while, but the S&P recovered and went on to have a banner run-up in 2009 – 2019.

Asset Allocation

Asset Allocation is the science of adjusting our investment weightings to match our goals. That’s my definition, I thought it sounded cool. Here’s what it means.

Our portfolio assets should be allocated across Equity (stocks & stock mutual funds), Fixed Income (bonds and bond funds), and Cash (High yield savings, Bank accounts, CDs).

We need to have money that we’ll need in the next 5 years or so in assets that are unlikely to (or better yet, will not) lose value. If we have money set aside for a pending home purchase, this needs to be in cash. We can’t afford to have a market down-turn make us homeless.

The money we are saving for retirement 10, 20, or 30 years away, should be largely in equities. We know that they grow an average of 10% a year every year, but we also know that in some years they go down 40% or more. We also know they sometimes have several down years in a row. History tells us they come back – they always have – but equities have their own time schedule. They don’t work on our schedule.

Fixed income is a good middle ground. It doesn’t have the highs and lows of equities, but provides a less-volatile source of regular income.

More reading here, here, and here.

Summary

We need to invest. We like the safety of fixed income and the dependable income it provides, but we need equities. Want to take a bite out of inflation? Invest some cash in IVV. As much as our food, gas, electric and other prices have gone up, our gains in IVV largely offset the entire impact of inflation.

The big guys may have the market rigged and may be making the biggest windfalls, but buy and hold investing in low-cost S&P 500 mutual funds has been a proven winner over the last 100 years.