Given the excitement with the impending government shut-down and the politicking around a spending bill, I wanted to re-visit some of the info regarding government spending here in the good ole’ US of A.

I posted about this a while back, if you’d like to take a peek. Read here.

And before we get started, this is not a political post. Both democrats and republicans have made strong contributions to the growing US national debt. It is however, political in the sense that all politicians seem to be spending (our money) like drunken sailors. Here’s some info to support that. Read here.

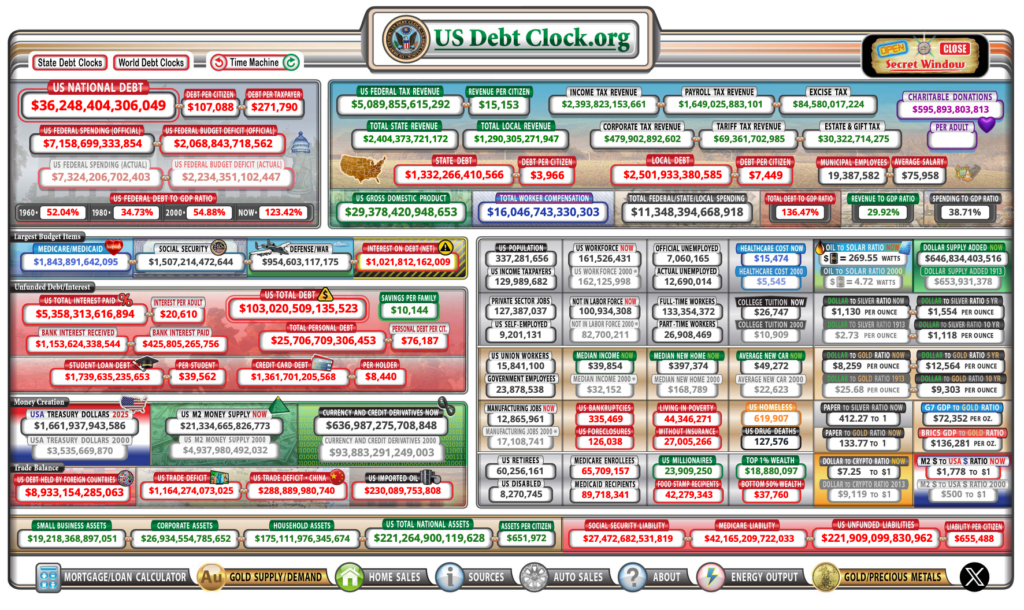

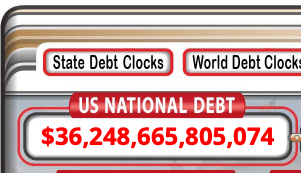

The title of my earlier post Is Debt a Problem? was a bit misleading. I was exploring debt, but talking about the US debt. What’s alarming is this post was published earlier this year, and the US debt at that time was a whopping $34 trillion. That’s a lot. Today, a few short month’s later, that debt is $36 trillion.

Here are the details. You can see the US debt clock real-time here.

Take a few minutes to peruse.

For every tax payer reading this, your share of the debt is $271,790. Would you like to pay that in cash, check or charge? Now might be a good time to consider a Roth conversion. You can read more here.

The interest that the US government pays each year on our debt now exceeds the spending on defense. This is loan interest. We get nothing for it.

Also, check out the time machine feature so you can see all of these values in the past, and you can project into the future.

Is This a Problem?

Numbers like $36 trillion are too large for me to even consider. That’s why I find this website particularly helpful, because it puts some of the impacts into a perspective that is easier to understand.

My share of this debt is $271,790. That’s a big chunk of change. The government runs on taxes. That’s its source of income. The only way to pay down this debt is to collect more from us – the tax payers. Or they could spend less – ha ha.

The taxes I, you, and corporations, pay today don’t cover the nation’s spending, so this debt continues to grow. My future taxes won’t go to paying down this debt unless some major changes are made.

So yes, I believe this is a problem. Let’s look at why.

US Treasury Bonds

I love treasury bonds. I can buy a 1 year treasury bond today for $1,000 and get 4.27% interest ($42.70) and then get my $1,000 back in a year. That’s cool.

A treasury bond, like a corporate bond, is a financial instrument used to raise capital (money). In this case, the US government needs to raise money to fund its spending on various programs. To raise capital, it issues treasury bonds. Treasury bonds are very popular because they are backed by the full faith and credit of the US federal government.

Lots of people, corporations, sovereign wealth funds, pension plans and mutual funds buy US treasury bonds because they are a safe and reliable investment. Buyers can be confident that the lender (the US government) will make regular interest payments and will return the principal when the bond matures.

All good so far. But, as our voracious appetite for more and more government spending grows, taxes alone don’t even come close to covering our needs. So we need to issue more and more treasury bonds. Great for investors, but the US is on the hook for the interest payments and the return of the principal invested.

The US government is now in the same hole that many US citizens are in. We have huge interest payments – debt interest now exceeds our largest spending category – defense. The burden of paying this interest is huge. And return of principal is becoming problematic, right? Not really, we just issue more debt to cover the principal repayment.

Don’t believe me? Take a look at the debt clock and watch the debt grow in real time.

The debt has grown by over $200,000 since I started writing this post. I took a break for breakfast, so it’s been a couple of hours.

Fiscal Responsibility

Read more here.

Some big words, but we get the idea. It means making good decisions about balancing spending, saving and the use of debt. It means making trade-offs. I’d love to get a new car but I can’t afford it. I’ll start saving now and maybe I can buy one next year.

Fiscal Responsibility: I just came back from breakfast. I love the breakfast burrito at the Depot diner, but last time I went there, it cost over $50 for breakfast for 2. Instead I had eggs and ham at Peg’s. It was $12 for two people.

I want to see a friend. I’d like to have breakfast with him. I can’t afford to spend $50. Let’s find an acceptable alternative. Peg’s coffee wasn’t great, but the ham and eggs were good and it was great to catch up with Brett.

Fiscal Responsibility

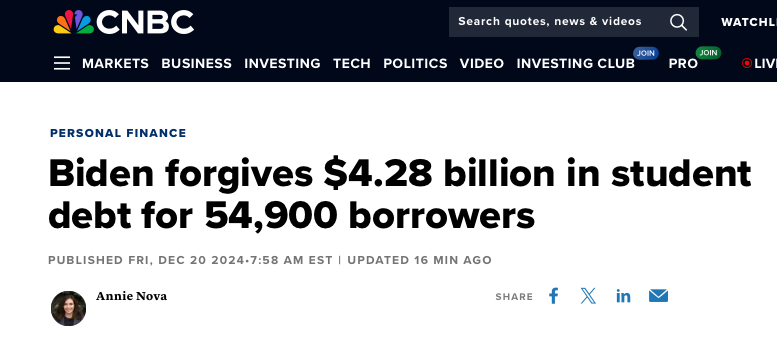

Not Fiscal Responsibility

Warning…this is slightly political…

This is a nice thing to do. People are struggling with debt. The US government is helping them. This is nice.

Is Mr. Biden using his money to do this? Yes and No. He’s a taxpayer, so he’ll be responsible for a portion, but this is government spending funded by taxes, but mostly funded by issuing additional debt which we (the US taxpayers) will need to pay interest on and will need to payback in full at some point in the future.

It’s Coming to a Head

I am hugely frustrated that our elected officials – democrats, republicans and independents, can’t seem to come up with a budget. How often do we hear about last minute stop-gap spending bills that narrowly prevent a government shut-down. Why can’t our elected officials come up with a budget? Isn’t that why we elected them? Maybe we should elect someone else?

Warren’s Plan

Buffett stated, “I could end the deficit in five minutes. You just pass a law that says that anytime there is a deficit of more than 3% of GDP all sitting members of congress are ineligible for reelection.” Read more here.

Wrap-Up

It’s hard. I get it. It’s hard for me to forego the burrito for the ham and eggs.

I’m joking, sort of, it’s more than that. We all make hard decisions. Sometimes we have to tell the family we can’t afford the vacation we had planned. Or maybe even we can’t afford the college of our child’s choice, or college at all. These choices are really hard and we know it’s not just ourselves who suffer. Our loved ones will bear the brunt of some of these decisions and they’ll be angry. But that’s fiscal responsibility.

Our government hates to say no as well. But they need to. We need them to make responsible choices about what to spend on and what not to spend on.

Right now, there is a stand-off. Some elected officials will not sign-off on a stop-gap measure to keep the government running by increasing spending. This will hurt. It means additional chaos for holiday travelers. National parks will close. Some folks won’t get a paycheck.

I believe we need some fiscal responsibility. We’ve elected smarter people than me and we need them to use their intelligence and their influence to figure out a way to save a few bucks so that we can get our debt under control and spend on the programs that are most valuable to the American people.

And it’s not all or nothing. It’s not fund a program or don’t. We need to find a way to spend more efficiently. Perhaps our elected officials could gain some inspiration from my post on saving.

Today’s task for me is to write letters to my representatives in the house and senate asking for their help to solve this problem.