I hate catchy titles like this, but I wanted to put together a post that captured the simple things that all of us can do that will greatly improve our financial situation over time.

I emphasize over time because time is the key. Read more here. The post starts with a woman named Sylvia who built a fortune over 60+ years. It also talks about how compounding works and why that is important to understand. You can read more about compounding here.

I’m getting ahead of myself, but I wanted to emphasize the component of time and how important time is in growing wealth. I understand that many readers feel the pinch today – whether it is overwhelming debt, the bite of inflation, or other factors that are causing a huge chunk of the population to live paycheck to paycheck – however, we also need to play the long game. We need a solution for today’s issues, and we’ll talk about those, but we also need to plan for our future.

3 Focus Areas

In order to improve our financial health, there are 3 focus areas that we must focus on, and balance.

- Saving – we need to put aside some money. I understand this sounds insane for folks living paycheck to paycheck, but we’ll talk about some easy ways to do this.

- Investing – Saving is a good start, but saving alone is not enough to build wealth. Investing means buying something of value with the expectation that the value will be higher at some point in the future. Stocks, Bonds, Mutual Funds and ETFs all play a role in our investment strategy and we’ll talk about each in detail.

- Wealth Protection – Lots of people want to get their hands on our money. Some are legitimate marketers while others are scammers who try and trick us (funny thought, how can you tell the difference? Some marketers are pretty aggressive – is there a difference?). More to come on both.

Today’s Thought

Actually it was yesterday…I was filling up at the pump yesterday and the total cost to fill my tank was $75. I paid by credit card and went on my way, but then started to think about how we get desensitized to costs. Often times we think of things like filling up the tank as necessities. We need gas to get around and we just have to do it. There is no other way. We tap our card and go on without a second thought.

However, we do have choices. In the end, it is up to each of us to decide, but it is important to recognize that we have choices.

And by the way, when I filled up, I used my Discover credit card that gets 5% cash back this quarter on gas stations, and I filled up on a Tuesday because I have T-Mobile and they have a T-Mobile Tuesday promotion which has a save an additional 15 cents a gallon on Fuel Rewards purchases (I normally get only 5%). Between the 5% cash back and the 20 cents a gallon, I saved about $7.50.

Saving

Ugh! I know, we’re all saying it. Saving is right up there with New Year’s resolutions on the list of things we hate – right? No one wants to deprive themselves and when we do, resentment builds up and we rebel, and then go back to our old habits.

So my promise to you is that we will not talk about depriving ourselves of something we want.

I will ask you to look at the choices you have. I will also suggest that you make saving a competition – even if just with yourself. I’m pissed that I spent $75 on gas Tuesday. Think of all the things I could have done with $75 – a round of golf with cart, a nice dinner out, or invest it and it could be worth $825 in 30 years.

Budgets

Here’s another “ick”. Who wants to do a budget – that doesn’t sound like fun? However, unless you end each month with much more money than you need, you need a budget. It’s really not as hard as you think. There are 3 steps – let’s look at each.

Step 1 – What do I spend now?

If you use checks, credit cards and autopay, this is pretty simple. If you use cash, this may be a bit harder. Pull together your checkbook, credit card statements, receipts or whatever you’ve got and start a list. Groceries, Rent, Electric, Heating…I like to do a monthly budget so it’s pretty easy to go back and look at what I spend in a month, but don’t forget things that aren’t regular monthly payments, but still need to get paid. In my first attempt, I forgot that I prepaid my insurance for a full year in July. I now know that I need to put money aside each month so I’m prepared when that bill comes due. This is a line item in my budget.

Be patient with this list. I found that new items showed up throughout the year and it took me a while to get a comprehensive list.

Step 2 – What comes in?

For most of us, this is just our paycheck – after taxes and other deductions. But you may have rental properties, alimony, interest payments or other items you want to include.

Step 3 – Make some decisions

First decision should be to make saving a priority. Putting money away to save and invest needs to be high up on the list. Saving cannot be the money that’s left over because nothing is ever left over.

Look at everything else. Is this how you can best allocate your capital? If it is, that’s fine, but I found some things that made me mad. I spend how much on cable TV each month??? I cut the cord somewhere around 2009 and never looked back.

How to…

I have a post that go into more detail on budgets. I also talk about account aggregators that help you pull your account info together in one spot and help you create a budget. Read more here.

Saving (2)

Back to saving…again, but this is important. Hopefully we’ve found some items to adjust or eliminate like I did with my cable bill, but now that we have our list together, we need to look at our spending and see where we can cut some corners. My wife and I both make this a competition. We’re both competitive and we are always looking to shave a few bucks. I have a couple of posts that talk about how we’ve saved. In almost all cases, we did not deprive ourselves and we felt proud of achieving some savings. Read more here and here.

Going back to my gas fill-up from Tuesday. I’m still pumped about the 7 bucks I saved. This is far from life changing, but consistently finding savings will build wealth.

While we’re on gas, my golf buddy was teasing me yesterday because I drive like a turtle. I told him the reason is because I’m an old man, but it’s more than that. Over the past year, I have averaged 36 miles per gallon in my 2021 BMW 530i xdrive. Not bad. I bought it used. the previous owner logged 28 miles per gallon.

The average driver puts on 12,000 miles per year. Gas is about $4 per gallon. At 28 miles per gallon, I’d pay 12,000 / 28 X 4 = $1,714.28 for fuel each year. At 36 miles per gallon, I pay 12,000 / 36 X 4 = $1,333.33. I’m saving $381 per year on gas.

Emergency Fund

Having an emergency fund straddles the line between saving and protecting your wealth. Regardless of how much money we have, a large unexpected expense can derail our plans.

Cars are complex these days. My first car was a 1971 Chevy Monte Carlo. It was a disaster. But I could stand in the engine compartment while making repairs. Most weekends involved a trip to the junkyard and some time lying under the car swapping out a starter or attaching soup cans to the tail pipe with hose clamps.

My current car has more computing power than the first space mission. It has several large display screens and I can barely fit my hand into the slot to pull out the oil filter. Most repairs require a trip to a real mechanic and that costs real money. Many functions, like adjusting the heat/ac are done through the infotainment system so a problem with that is a real problem and that costs $3,000 to fix. See info from our friends at repairpal.

For most of us, an additional $3,000 is a problem. It means credit card debt, borrowing money or sacrificing something important, like eating. This is not something easily absorbed.

This is why you need an emergency fund. Start small, Squirrel a way a few dollars here and there. keep it close – in a piggybank, safe, under the mattress, anywhere you can get at it quickly. While financial professionals will tell us that we need an emergency fund to cover 6 month’s living expenses, an emergency fund is built slowly over time. A small emergency fund is better than no emergency fund. Read more in the post on budgets.

Investing

Show of hands, who was taught investing in school?

Exactly.

I was lucky enough to spend 30+ years working in financial services with lots of great folks who were willing to teach me the ins and outs of investing. I teach classes and write these posts because I know most folks haven’t been as lucky as I and could use a little help. Investing is scary. And the investment industry and the government have made it even more so in an effort to make it easy – nice going! Ever try reading a mutual fund prospectus?

We’re going to go through investing in 2 sections. The first will be for folks who want the easier hands-off method. Then later we’ll tackle the more complex topics for people like me who make investing a hobby.

Why Invest?

Why do I need to invest? My parents never invested and they’re doing fine. Yeah, but your parents had a lower life expectancy than you and they probably have a pension.

My dad died at age 76. My mom is alive and living off of her, and my dad’s pensions. So for her, things are good – one person living off of 2 pensions.

Pensions

Pensions are few and far between these days. It’s not because companies are mean, it is more a matter that they are not financially viable. Neither is social security, but we’ll save that for another post.

In 1940, life expectancy was 62 for men and 66 for women. It was financially viable to offer a pension as a benefit because a man retiring at 65 likely wasn’t going to live much longer so the company would not have much to pay out.

Fast forward to today, we’re living into our 80s and 90s. Can a company afford to pay a partial salary to each and every employee from the time they retire at 65 until they pass on 20 or 30 years later?

Defined Contribution Plans

Pensions are known as defined benefit plans. The benefit (for example, 70% of salary after retirement) is defined, or fixed. In defined contribution plans, the participant defines the contribution amount, but the benefit (what they receive at retirement) is variable based on market conditions and investments chosen.

Before we go on, please read the post on retirement plans for much more information. This goes into all the details like deferrals, vesting and investment options that we need to know in order to maximize the value of our defined contribution plans.

In my opinion, a defined contribution plan is the easiest way to invest. The money comes out of our paycheck automatically, it is invested in mutual funds and we don’t need to think about it too often.

Again, the post here will tell you all you need to know, but your employer may also be a resource. Your HR department should be able to help you, but often companies don’t have the expertise in-house so they outsource this responsibility to Fidelity, T Rowe Price, Vanguard, Transamerica or other experts. If you can’t get the answers you need, post a comment or send me a note through the contact page. I’ll answer right away.

Mutual Funds

Is Gamestop a good investment? Will Nvidia continue to outperform? Can huge companies like Amazon, Apple, Meta and Microsoft continue to grow or are they too big? If all of this gives you a headache, then mutual funds are for you. Mutual funds are a basket of securities chosen by a portfolio manager or could be a group of securities chosen to represent a specific market index. Read the post on mutual funds to learn more.

My personal favorite are low-cost S&P 500 mutual funds and ETFs. An example would be:

Let’s talk about what these are.

The iShares Core S&P 500 ETF is passively managed. It does not have a portfolio manager. It buys shares of the companies in the S&P 500 index. The S&P 500 is an index of the 500 largest US public companies. This includes Amazon, Apple, Microsoft, Berkshire Hathaway, as well as GM, Coca Cola, and PepsiCo.

It is an ETF, or an exchange traded fund. It is quite similar to a mutual fund, except that it’s shares are traded on an exchange so it’s price changes throughout the market day v. a mutual fund which prices once per day. More on this here.

Its expense ratio is 0.03%. The expense ratio shows how much shareholders are being charged by the fund management company to manage this investment. Index funds and ETFs are fairly cheap because they follow an index. They don’t need to pay research analysts and portfolio managers. An expense ratio of 0.03% means that as a shareholder, we will pay $3 per year for every $10,000 we invest. That’s a pretty good deal.

Asset Class

Even if we’re buying mutual funds, we need to understand what asset classes are. The 3 major classes that we’ll deal with in our investing are Cash, Fixed Income and Equities.

Cash (also known as Cash and Cash Equivalents) would be the money we have in checking, savings, high yield savings and CDs.

Fixed Income is typically bonds – where the income percentage is known, or fixed. For example, a 1 year treasury bond is paying about 5% today. If we invest $1,000, we will get $50 in interest payments over the next year and we will get our $1,000 initial investment back at the end of the year.

Equities are a little more complex, but they are essentially ownership of a company. If we buy shares of an equity security, for example Microsoft, we become a shareholder – or owner – of Microsoft. We participate in the gains and losses as the stock price moves. As an owner, if Microsoft authorizes a dividend payment, we will be entitled to receive our share.

For more reading, see asset allocation, stocks, fixed income.

Asset Allocation

Asset allocation is the practice of deciding how to allocate our capital to our asset classes.

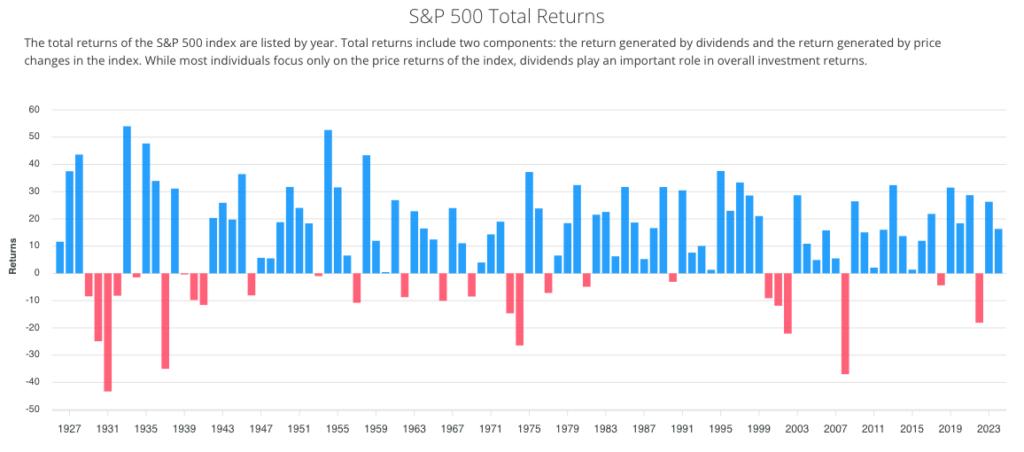

Traditionally the S&P 500 index, which represents the US equity market, has delivered an average of 10% annual return with dividends reinvested, over the last 100 years or so. That’s pretty good, but it’s been a wild ride. The S&P 500 has been up 50% in some years and down 50% in others. See the details from our friends at slickcharts.

As an investor, this doesn’t worry me. I manage my allocations between Cash, Fixed Income and Equity so that money I need in the next 5 years is not in Equity. Imagine having the money you need for a downpayment to purchase a home in an S&P 500 fund in 2008. You would have lost almost half of your downpayment and would likely be living on the street. However, if your retirement money was in an S&P 500 fund in 2008, preparing for your retirement in 2019, you wouldn’t have even noticed. There was a pretty big dip of 40%, but by 2010, you were back to 2007 highs. More on Equity here.

Fixed income (bonds) provide a nice level of income, along with less volatility. Holding bonds helps balance out some of the volatility in equities. If we hold a bond to maturity, we’ll get our money back (providing the bond issuer doesn’t default on its payments) but we can lose money if we have to sell a bond before its maturity date. More on bonds here.

It also helps to have cash during a down market because it doesn’t lose value. But, cash often barely keeps pace with inflation. It’s the place for your emergency fund, for the money to support your budget, and for planned purchases in the near term, but it is not a suitable investment for wealth-building.

Wealth Building

The 2 key tools required for wealth building are equities and time. For equities, we’ll assume we’re investing in a low-cost S&P 500 fund or ETF. We know we’ll have up periods and down periods. Go back to the chart above. There are some jaw-dropping down years. And they arrive fairly frequently. But there are a lot more up years than down. This is the reason that the S&P 500 has averaged 10% per year with dividends reinvested over the last 100 years.

Interesting stats, but let’s look at an example.

I’m 21 years old and starting my first real job. My company has a 401k plan so I decide that I will contribute $200 per month to the plan. This comes out of my check directly and I don’t have to think about it. I invest the money in an S&P 500 fund. For this purpose, we’ll assume an 8% return v. the 10% average we talked about earlier. If I’m retiring at 66, roughly 45 years away, this is what I may have.

You can try this yourself at acorns.com

The $200 a month is great when I start out, but as my salary grows, I’m likely to add more to my monthly contribution. This will further increase the money I will have in retirement. Look again at the post on compounding for more examples.

Wealth Protection

Back in the early days of email, the Nigerian prince scam emails were popular. I’m happy to report that they are still around. Check out the email I got a few months ago.

Who needs to worry about boring stuff like saving and investing? Clearly I am the person to execute this business transaction and score a cool $6mill.

I’m sure if I clicked any of the links, my bank account would immediately be emptied.

Funny as this may seem, people are falling for these. How easy is it to send emails out to 10 million people? There are services that will do this pretty cheap. All you need is one in 10 million to click.

I have several other posts on scams here, here and here.

We need to build our wealth but we also need to actively protect it.

Data

Many of us freely share our data on social media. In addition, there are companies known as data brokers, who are legitimate companies that buy data and then sell it to anyone with a credit card and an email address. While the advertised use for this data seems legit – like improving the ads we see, the not so legit usage is to try and seperate us from our money. Some of this is through scams, but some is through legitimate businesses using this data against us. Read this post on insurers using this data to jack up our rates.

Auto-Pay

I love auto-pay. It has simplified my life tremendously. While I love it, I don’t trust it.

I started helping my mom with her finances a while back. I took a look at her credit card statements and saw a fairly regular charge for $29.99 from a business I didn’t recognize. It wasn’t a legit charge. Someone had grabbed her card number, expiration date and code and was submitting this transaction regularly. The amount is small enough to fly under the radar and the business name looks legit. Look at your statements and challenge errors.

I also noticed my mom was paying more than she should for cable. Her bill showed that she was subscribed to the Spanish channel and the daily burn. Likely an error, but she is 87 and doesn’t speak Spanish. She also rented the Barbie movie. I’d like to think this is an error, but either way, keep your eyes open.

I catch a lot of this through alerts. Most credit card companies let us set up alerts for card not present, transaction over a certain dollar amount, and others. We can get a text right to our phone. This helps keep on top of anything suspicious.

Advanced Investing

Remember I said we’d talk about this? Many folks are happy with low-cost index funds and other types of mutual funds. These days there are thousands of funds to let us focus on specific industries, countries or other special focus areas.

I continue to hold a large chunk of my retirement money in low-cost S&P 500 mutual funds, but I like investing and reading about companies and industries so I buy individual stocks. If this appeals to you, I have many posts on investing. I have posts on stocks so you can learn ore about what it means to be a part owner of a company through stock purchase. I have a post on capital markets and how they work. Check out the post on dividend stocks to learn more about how some companies pay a regularly payment to their shareholders (that’s you).

When you’re ready to invest, read the posts on creating an investment thesis for a company here and here.

And make sense of a company annual report by reading here, here, and here.

As an investor in stocks, you’ll want to ensure you are beating the market – otherwise why not just invest in a low-cost S&P 500 fund. Read more on how to measure stock performance here.

Look through the blog page. There are many posts on my experiences and the lessons I’ve learned over many years of investing.

If there is a topic that interests you and you haven’t found a post, let me know through the contact page and I’ll write one.

Summary

Not that tough, right? Put some money away to create an emergency fund. Put a little more aside to start investing. Use your company defined contribution plan. Use a budget to help you take control and make decisions about where your money goes. And then, be aware of all the legit and non-legit actors who are trying to siphon off your wealth. Be cautious. Review statements and set up alerts.

And mostly, stay the course. This doesn’t take frequent correction. Turn off CNBC and stick to your knitting.

I hope this post, as well as the many posts on the blog page help simplify a complex set of topics so that readers will have the confidence to take action to ensure their financial future.

Good luck and let me know if I can help.