It’s almost 2026. Can you believe it???

At around this time every year, most investors start reading articles about how it’s time for a year-end check-up. It seems like a lot of work so many investors just move on and stick with the program.

And honestly, this isn’t the worst reaction. With investing, often laziness is your best friend. Choose reasonable investments, set up regular contributions, and sit back and let them do their thing. Often we’ll wake up 20, 30 or 40 years later with an impressive nest egg.

But today’s post is about doing just a bit more AND making it simple.

Taxes

Bear with me. It won’t be that bad.

To me, there is almost nothing worse than paying taxes. Pre-retirement, taxes were withheld from my paycheck so it was less of an event. Now, I need to pay estimated taxes quarterly. It’s a constant reminder.

So, here are a few things to reduce the pain.

Health Savings Account

A health savings account, or HSA may not be right for everyone. The key reason is that it requires us to have a High Deductible Health Plan (HDHP) in order to qualify to contribute to our HSA.

I love my HDHP. My wife and I are healthy so our medical expenses are low. Even with a low deductible plan, we still wouldn’t hit the deductible. So for us it works.

But, if you’ve got lots of prescription meds and health issues, the tax savings of the HSA may not be worth it.

For those of us that want to try, we sign up for a lower price health plan with a higher deductible. We make sure it is HSA eligible, and we pay lower monthly premiums and we get to contribute to an HSA.

An HSA is the holy grail of savings. It has a triple tax advantage. Money goes in pre-tax – no taxes today, it grows tax-deferred – no taxes on dividends, interest or cap gains, and as long as we use it for qualified medical expenses, we can withdraw it tax free. More about HSA here.

Per Fidelity, here are the 2025 limits:

Here’s your to-do

If you have an HSA, make your contribution.

If you don’t, decide whether one makes sense for you and your family. If so, sign-up and make your contribution.

Roth Conversion

For all of us who have been saving and investing, the market has been good to us. A nice low-cost S&P 500 fund has historically returned about 10% per year with dividends reinvested over long periods of time.

That’s great news for wealth accumulation. Congratulations!

But for many of us, we’ve accumulated that wealth in a tax-deferred 401k or IRA. And our Uncle Sam is not a patient man. He wants those deferred taxes.

And as soon as we turn 73, he’ll get them.

At 73, we’ll be required to take Required Minimum Distributions (RMD) from our traditional 401k and IRA. And depending on how well I’ve saved and invested, the required distribution could be a whole lot more than I actually need. Doesn’t matter, Sam says “it’s time to pay your taxes – you gotta take it.”

I’m 11 years away from my first RMD, but if my IRA grows at a conservative 6% per year for the net 11 years, I’ll be taking a large annual RMD, on top of my Social Security, and some dividends and Cap Gains from my brokerage accounts and other after-tax savings accounts.

This is bad news. It could bump me into a higher tax bracket and IRMAA could kick in.

Watch out for IRMAA. IRMAA is Income-Related Monthly Adjustment Amount. If our income exceeds certain thresholds, we’ll start paying more for Medicare Part B and Part D. Here’s more from Nerdwallet. This ain’t peanuts. At the upper end, we’ll be paying out an extra $689.90 for Part B premiums each month.

Don’t mess with IRMAA.

Roth conversions today can save us some tax and IRMAA pain down the road. For a Roth conversion, we take a distribution from our traditional 401k or IRA today, pay the taxes today, and put the money into a Roth IRA. Once in the Roth, we’ll never pay taxes on these amounts again. they grow tax free and we withdraw tax free.

And there are no RMDs for a Roth so we may be able to dodge IRMAA.

Roths are a litle complicated. The biggest challenge is getting the money together to pay the taxes today. Read more here.

Grok is very helpful. I fed some info about my age and account balances into Grok and he put together a tax and IRMAA optimization plan that included yearly Roth conversions. He’s quite helpful, you just need to ask.

Taxable Accounts

Most of us have some money in a taxable brokerage account, a high yield savings account, or even a bank checking or savings account.

Interest and dividend payments are cool, but they’re also taxable in these accounts. I worked hard to build an income stream, but it also adds to my taxes.

I’ve become a big fan of municipal bond funds and municipal money market funds. These are lower risk, but not FDIC insured. But, the dividends and interest is federal tax free and may be tax free at the state level depending on the fund.

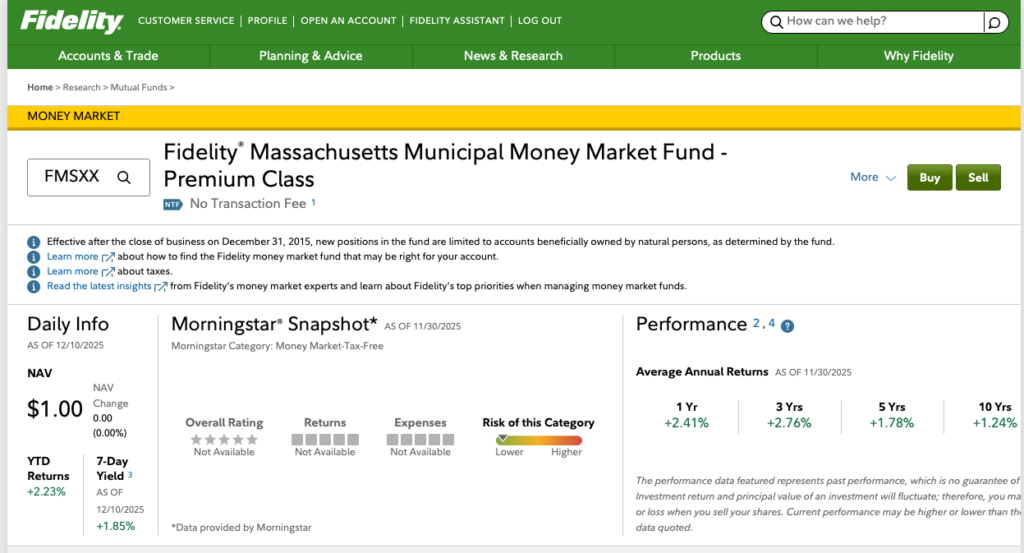

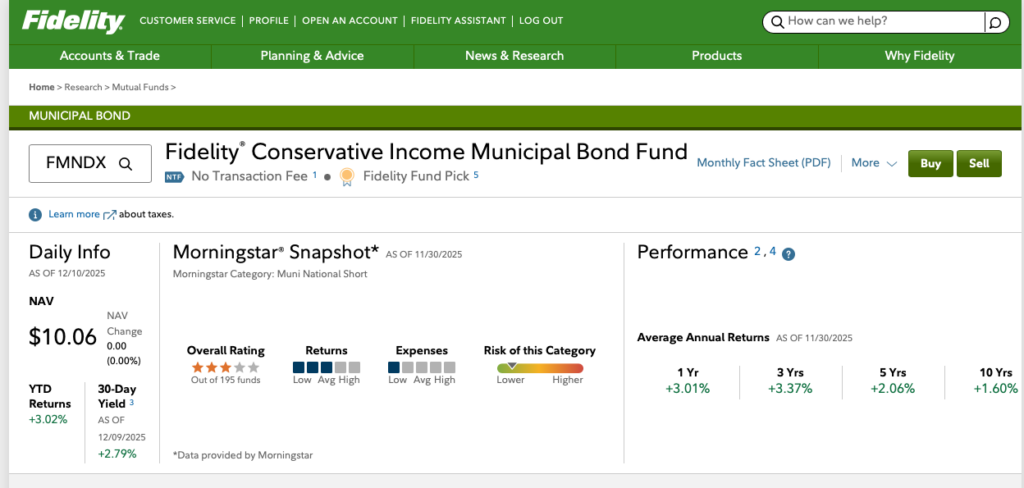

Fidelity® Massachusetts Municipal Money Market Fund – Premium Class is not going to make you rich. A YTD return of 2.23% doesn’t look like much until you consider that we won’t pay either state or federal tax on the income it produces.

We could take on a little more risk with Fidelity® Conservative Income Municipal Bond Fund. No state tax advantage, but a little boost in returns. And still very conservative.

We may be able to get a higher % yield from a high yield savings account, but the tax advantage could make one of these funds a better investment and can also lower our adjusted gross income.

Asset Allocation

That’s enough fun with taxes, so let’s move on.

Here are some questions to think about before we dive in.

- How old are you?

- How much do you have saved?

- What’s your current allocation – % equity, % fixed income, % cash

- What’s changing in the next 5 years?

- Retirement coming?

- Kids going to college?

- Someone need braces?

- Considering paying off the mortgage?

- Buying a boat or a summer home?

- Home projects? I did both Solar and new windows this year – ouch!

I like to have a separate account for each goal. We have one for each of our grand-kid’s college fund. At one point, I had an account to save for a new car. And I have a few different retirement accounts. So does my wife.

It takes me about 2 minutes to set up a new account on my brokerage website and another 2 to set up a recurring transfer and reinvestment.

For the grand-kids, they’re 4 and 1 so they are 100% allocated to an S&P 500 fund. This will change when they’re 5 years away from their first college payment.

My retirement accounts are about 60% equity.

When I had the car account, it was mostly in bonds. I was saving money regularly and I couldn’t afford to be in a position where the market dropped and I could no longer pay for the car.

Ideally, each account is tied to a goal so that it’s easy to set an appropriate allocation.

Equities

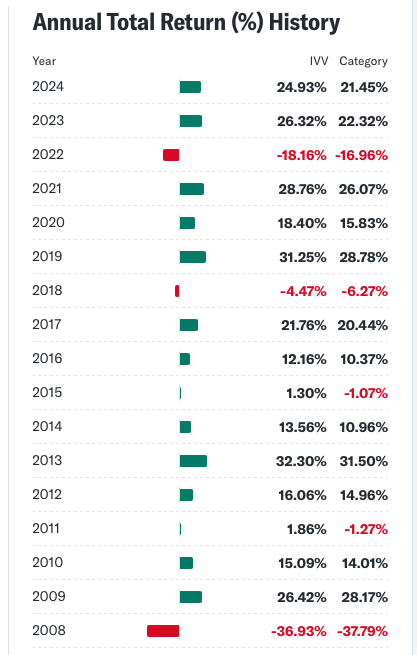

For equities, I almost always choose a nice low-cost S&P 500 find like iShares Core S&P 500 ETF (IVV). It averages about 10% return per year with dividends reinvested. It’s volatile.

IVV was down big in 2022 and 2008. But look at 2019, 2020, 2021, 2023, and 2024.

With IVV I know I’m getting volatility. If I hold it more than 5 years, chances are pretty good I’ll be ahead. If I hold it 10 years, the chances are pretty good I’ll get to that 10% per year. The longer I hold, the higher the odds are that I’ll hit the 10% per year average.

And in those really bad years, it typically takes 2-3 years to get back to where I was.

I know that equities build wealth, but they’re also volatile. I need equities for a 5 year + goal, but as I get within 5 years, I’m starting to move from equity to fixed income and cash.

Fixed Income

Fixed income provides a fixed income. Ha Ha.

If I buy a 5 year Walmart bond that pays 3% interest with a face value of $1,000, I know that I’ll get an interest payment yearly for $30 and that at the end of the 5 years, interest payments stop and I get my $1,000 back.

But there is always a chance that Walmart falls on hard times and is unable to either make their payment to bond holders, or is unable to pay back the principal. That’s default risk. And while unlikely with Walmart, it happens with high yield (junk bonds).

There’s also interest rate risk.

I’m loving my $30 payments from Walmart, but what if the kids need braces and I have to sell my bond. If rates have increased since I bought my bond and a new Walmart bond offers 4%, who is going to buy my 3% bond? You got it, no one.

So I need to put my bond on sale in order to attract buyers. It turns out to be an easy calculation. Bond buyers are capitalists. They only care about the money.

I’m currently getting 5 payments of $30 each, so $150 in total bond interest.

The new 4% bonds will get $40 per year for 5 years, so $200 in total bond interest.

If I drop my bond price by $50, that makes up for the difference in bond interest so selling my 3% bond at $950 is exactly the same as buying a nice new 4% bond for $1,000.

But I lost $50 on the deal. Ouch.

This is why I buy a nice bond fund like the Fidelity Total Bond ETF. Let someone else pick a basket of bonds and manage the risk. Just remember that the price of the fund can go down, and the interest rate will change as the fund buys and sells bonds.

But, FBND will be much less volatile then IVV.

Cash & Cash Equivalients

Overnight Notes, Swaps, Commercial paper, Variable rate demand notes….these can be similar to cash but provide a bit more return. Cash and Money Market fund managers deal with these, not real people like us.

But either way, whether we invest through a money market fund or we have a high yield savings account or bank account, cash is pretty safe.

And often it is FDIC insured.

We won’t make much, and we’ll often lose to inflation over time, but it is there when we need it.

Allocation

Our asset allocation is how we plan to arrange our assets in these 3 buckets in order to maximize return while ensuring we can meet our goals.

And spoiler alert: there is no right answer. Asset Allocation is our best attempt to take advantage of leading areas of the economy while protecting ourselves from lagging areas.

Here’s an example. In preparing for retirement in 2018, I sold large chunks of equities – Amazon, Alphabet, Apple and Disney, and moved the proceeds to cash and bond funds.

I’ll need the cash to pay my living expenses, and the bond funds will be available in case I need it and will provide a little more income than cash would.

Here’s a quick table to show my sales and how they’ve performed since.

Disney has stepped in it a few times and it shows in Disney’s stock price performance. Not so for the others. I’d have been up huge if I’d just held on.

But back in 2018, none of us knew how these companies, or the S&P 500, or any investment, would perform over the next 7 years.

And that’s the point. My asset allocation changes in 2018 prepared me for some down years. We ended up having some great years for equities. I enjoyed the run up with my remaining shares, but the shares I sold provided the security I needed had there been a different outcome.

Learning is important. Second-guessing isn’t helpful.

So we make asset allocation decisions today to maximize our long term gains while providing some near-term security. That’s important.

Rebalancing

If you were paying attention, you probably noticed that the S&P 500 has been up big these past few years. That means that if we’ve made no allocation changes, and let’s say we were at 70% equity, 10% cash, and 20% fixed income a few years back, we’d be off-track now.

Equities have grown so much compared to cash and fixed that we are probably overweight in equities. While that’s great news, year-end is a good time to assess this and to adjust. Maybe we move some of those gains into our emergency fund or into a nice bond fund.

This can be even more evident with individual stocks. No one would be surprised that Nvidia and Broadcom are up big in 2025, but would you think that Caterpillar would be up 72.32% year to date?

Me neither. That snuck up on me. Time to sell a few shares.

I still believe in Caterpillar, but I want to limit my exposure. This also guarantees selling high.

Wrap Up

So there’s the checklist.

Being an investor, whether we actively invest through a brokerage account, or we invest regularly through a 401k, it helps to do a little annual maintenance.

It’s not that hard, and it really doesn’t take any special skills.

Follow this checklist and you’ll be ahead of most.