Should I buy an Annuity? Good question. Annuities are complex financial products. In this post, we’ll try and explain what an annuity is, some of the variations, and why an investor may want to consider one.

Insurance

An annuity is an insurance product. Much of what we talk about on finance-abcs.com is related to investments and investment products that are sold by banks, brokerages, or even governments (treasury bonds). Annuities are different in that they are a contract between the policyholder (us) and the underwriter (insurance company). This is important because in addition to being an investment product, an annuity is an insurance product which has some form of a guarantee that is backed by the insurance company.

Who is Involved?

Aside from ourselves, who we’ll refer to as the policyholder, and the insurance company who writes the policy and provides the guarantee, there is often a 3rd party in the middle. While you can buy an annuity contract directly from an insurance company, you may buy one through a broker, financial advisor or other investment professional. It’s important to know the role of all parties involved. We’ll discuss why in a bit.

Types

To prepare for this post, I did some reading. I think I know less about annuities now. Fixed Annuities, Variable Annuities, Fixed Indexed Annuities, Deferred Annuities, Immediate Annuities…pretty confusing. Let’s leave all this aside for now and take a big step back.

Guarantee

It can be overwhelming to be responsible for managing our money in retirement. In the good old days of defined benefit pension plans (read more here), we worked for a company for our entire career, and when we retired, we got a paycheck every month until we died. Pretty simple.

Fast forward to today and defined contribution plans are the new standard. Each of is is responsible for saving for retirement. And then when retirement comes, we need to manage that nest egg, deciding what to invest in, how much to allocate to stocks, bonds, and cash (see more on asset allocation here), and how much we can take out each month to live on.

That’s a lot of work and uncertainty. Wouldn’t it be great to have some guarantees? That’s exactly what an annuity provides.

Many Flavors

There are lots of types of annuities as well as individual features that can be added to each type that make the annuity landscape complex. We’ll touch on the basics so that we’re able to have an informed discussion, but if an annuity seems attractive to you, find an insurance company representative or advisor that you trust, and dig in to the details.

Guaranteed Income

I’m not sure this is a term that annuity professionals use, but it is a term that helps me think about this type of annuity. Guaranteed income annuities provide the purchaser a guaranteed income stream for a specified period of time. Typically, the purchaser makes a lump sum payment to the insurer in exchange for a monthly benefit payment. The benefit payment will vary based on the age, life expectancy, lump sum amount, and features chosen at the time the annuity is purchased.

We’ll look at an example in a bit, but this type of annuity is for someone who has saved for retirement and wants to convert their retirement savings into a dependable income stream so that they don’t need to worry about choosing investments or risking a market downturn.

To me, this type of annuity is similar to our old friend the defined benefit plan.

Guaranteed Rate

Another likely made-up term. In a guaranteed rate or guaranteed minimum return annuity, there is no promise of an income stream. Instead the insurer will guarantee that the purchaser will receive a minimum return on their investment each year. Often times, the insurer guarantees the principal investment and promises a variable rate of return. Depending on the annuity type, the purchaser may have more or less control in choosing the investments. We’ll look at some variations later.

Guaranteed rate annuities are more like the defined contribution plan in that the annuity purchaser has more control over the investing, and specific payment amounts are not guaranteed.

Guarantee (2)

We’ve used the word guarantee quite a bit. There is a reason for this. Any annuity we buy is an insurance contract. Most of what we discuss at finance-abcs.com are investments: stocks, bonds, mutual funds, ETFs… For all these investments there are no guarantees.

An annuity on the other hand is an insurance product that comes with a guarantee. That’s what we’re paying for. We buy an annuity because we want some certainty. Either certainty that we will receive a check in the mail every month for a specified period, or the certainty that we will not lose money in the market, ever.

Guarantees Aren’t Free

The insurance company is taking on risk. If we choose an annuity that gives us a payment stream for life, the insurance company is taking the risk that we could live until we are 108 years old and they’ll have to continue paying well beyond the average life expectancy. If we choose an annuity that guarantees our principal and a 4% per year gain, the insurance company is taking the risk that the market may underperform and they will still need to make good on their promise.

The insurance company charges annuity purchasers a fee to take on that risk. The fee may be imbedded in the policy assumptions, or it may be explicitly stated (like an expense ratio) in the annuity investment choices. More on fees later, but be aware that you are paying for guarantees.

Also, don’t feel bad for the insurance companies. They have actuaries who work with tons of data on life expectancy and investment returns that enable them to make good decisions on how to offer a product that provides guarantees for policy holders and is profitable for the insurer. Everybody wins.

Immediate Annuity

An immediate annuity is an example of the guaranteed income annuity. When buying an immediate annuity, the purchaser is trading dollars today for income in the future. The issuer, who is typically an insurance company, takes the purchaser’s payment and invests it. The insurance company is betting that it can grow the purchaser’s money at a higher rate than the rate it is paying.

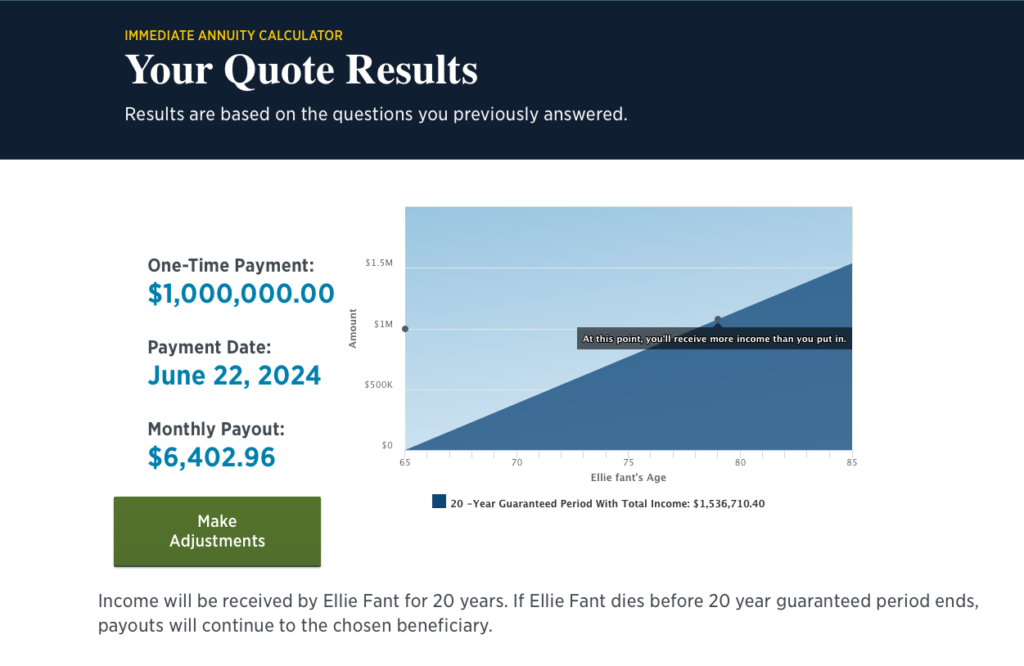

Let’s look at an example. I used USAA’s online annuity quote here. This is for demonstration purposes so that we can talk about how annuities work.

Here’s the scenario. I have saved well over a long career and I have $1,000,000 in my 401k. I’m happy about where I am now, but I’m worried about the future. I’m concerned about interest rates, the stock market, international instability, and I am not confident that I can manage my $1,000,000 in a way that it will last me for 20 years of retirement.

I decide I need the stability of fixed monthly payments and I am going to take the whole $1,000,000 and purchase an annuity. I am 70 years old now and I plan to purchase a 20 year immediate annuity.

How it Works

I send my $1,000,000 check in to the insurance company. We sign a contract that says for my $1,000,000, I will receive a monthly check of $6,402.96 every month for the next 20 years.

Over the course of the 20 years, I receive a total of $1,536,710.40 in payments. Not bad considering I only gave them $1,000,000. Also, this is guaranteed, unlike any investments I would have made in bonds, stocks, or mutual funds.

Is This a Good Deal?

We’ve traded our $1,000,000 for a guaranteed monthly payment for the next 20 years. Let’s look at what might have happened if we took the money and invested in a 20 year treasury bond. Again, courtesy of our friends at Acorns.com

This morning, 20 year treasuries are paying 4.84%, so we’d actually do better than this.

Considerations

The guaranteed $6,402 per month and $76,000 per year doesn’t look as good now in comparison. But, remember how treasury bonds work. We’ll use $1,000,000 to buy our treasury bond. It will pay us 4% per year annually ($40,000) every year for 20 years, and then we’ll get our $1,000,000 back.

Can we live on $40,000 annually v. the $76,000 that we’ll get with the annuity? Can we manage a yearly payment v. a monthly check? But, when the annuity ends after 20 years, we get nothing back, whereas with the treasury bond, we get our $1,000,000 back.

The trade-off is the guaranteed $6,402 per month for 20 years v. the lower annual payment and the uncertainty. Annuity buyers are looking for certainty, and that certainty comes at a price.

Inflation

This is a consideration, but a big one, so it get’s it’s own section. That $76,000 per year sounds pretty good. I’ve got a budget and I can see that this will cover my expenses with some left over for traveling and golf. Awesome!

Just remember, that $76,000 per year is fixed for the 20 year contract. Will $76,000 cover all of our expenses in 2044? It may, it may not.

Some annuity contracts offer an inflation adjustment. This will come at a price, but may be worth it.

Deferred Annuity

A deferred annuity is similar to the immediate annuity. The main difference is that while we sign the contract and start paying today, we don’t plan to receive payments until some point in the future. Since the insurance company is getting money today that it will not need to payout until a time in the future, it has a longer investment period and will likely offer a larger benefit (payment amount or additional features).

Fixed, Variable, Indexed Annuities

This group of annuities generally provide a guaranteed rate of return instead of a guaranteed payment (like the immediate or deferred annuity). As you might expect, fixed annuities provide a fixed rate of return for the life of the contract. Variable annuities provide a variable rate of return. Indexed annuities provide a rate of return that is linked to a particular market index like the S&P 500.

The level of guarantee provided, v. discretion of the policy-holder can be pretty broad.

High Discretion / Low Cost

I have a product called a retirement annuity that provides no guarantees, but allows me to invest money in a tax-deferred vehicle. I have total discretion in choosing amongst the equity, fixed income and money market investments that the contract offers. There is no guarantee that the investments will not lose value, and there is no guarantee that I will achieve a minimum rate of return. All I get from this is the ability to invest after tax money and not pay taxes on gains until I make a withdrawal.

Not much of a guarantee, but there is no up-front cost. The mutual-fund-like investments that the contract offers charge a minimal expense, which is what I pay for the ability to defer taxes.

Low Discretion / Higher Cost

I attended a sales seminar on indexed annuities. I really liked the advisor who was selling the product and I even considered investing. Here’s the pitch:

- Aside from a few relatively small pull-backs, the stock market (S&P 500) has been uncharacteristically strong since 2009.

- Wouldn’t it be great to take your gains now and lock in a guaranteed rate of return for the foreseeable future?

Yes

Of course it would.

This particular annuity guarantees that we will not lose our principal investment. It also guarantees a rate of return between 0 and 7% (I think these were the numbers) each year. If the S&P 500 returns 0 or is negative, our return is 0. If the S&P 500 is positive, we receive a portion of the S&P 500 gain, up to a maximum annual gain of 7%.

The S&P 500 has had many more positive years than negative years so this seems like a pretty good deal. There were also some cash bonuses (paid to the policyholder) involved, which I didn’t completely understand, but it certainly was a compelling sales pitch for protecting money in retirement.

Everything Else

The annuity industry is quite complex. There are many variations of the guaranteed rate type of annuity that can give investors some ability to choose investment options or adjust asset allocation. There are some that offer benefits like life insurance, or spousal benefits. Be sure to understand the benefits, responsibilities, as well as what you’re paying for. It’s important to have an insurance agent or advisor that you trust to help navigate.

Advisors

Whether it’s an advisor who works for the insurance company that is selling the contract, or an independent advisor, there is likely someone who will work with you to establish an annuity. This person is getting paid. Be sure you know how. You may want to meet with a few advisors before deciding who to deal with. This is a complicated space. Be sure you are working with someone you trust.

Risk

The guarantee, whether it is regular payments or a fixed rate of interest, comes from the insurance company that sells the annuity. What happens if the insurance company goes bankrupt? While I couldn’t find any evidence of this happening in the last 10 years or so, it’s pretty likely that the next 20 years or so will see some sort of financial crisis like we saw in 2008, 2001, etc… We’ve got our retirement riding on this annuity. We want to be certain that we’re protected.

Protections

Most insurance companies manage their policies quite conservatively. They are not betting our annuity money on bitcoin, they are more likely putting it in treasuries. But, we still want to be sure we’re protected. Insurance companies are rated by independent agencies like AM Best, Fitch and Moody’s. These agencies provide a financial strength rating that we, as potential customers can use to assess the likelihood that our annuity provider can keep their commitments.

Many insurance companies will reinsure pieces of their business. They essentially buy insurance policies with other insurance companies to reduce their risks.

Finally, most states provide some sort of protection for policy-holders. The federal government does not, so the rules are different state by state. Be sure to understand how your state deals with insurance company failures.

Before choosing an annuity, be sure to assess the financial strength of the insurance company that writes the annuity (note, this may not be the firm that sells you the annuity). And be sure to understand the other protections the insurance company and your state provide.

That’s a lot…This is why you need to buy your annuity contract from an advisor that you trust.

Wrap-Up

Should I buy an annuity?

That’s a really complicated question. If I’m concerned about managing my money in retirement, and some sort of guarantee is appealing to me, then yes, I should probably consider an annuity.

That’s the easy part. Now I need to decide what type of a guarantee I want and how much discretion I may want to have in my investment choices within the annuity. Some may say none, just send me a check. Others may feel like they want to be able to adjust their asset allocation to meet some of their goals in retirement.

The good news is that there are lots of options in the annuity market to satisfy most needs.

This is why finding a trusted annuity advisor is key. This person can help you navigate the options and features to develop a custom product that’s right for you.

That’s a lot. Let me know what you think and what questions you have.