I’m 62 and retired. Paychecks stopped coming over 5 years ago. I took the leap and retired at 56, after doing quite a bit of analysis on expenses, growth projections, and likely market scenarios. It seemed like there was a high probability that I could retire comfortably and my job just wasn’t that much fun anymore.

In my younger days, I was focused on growing my wealth. I invested in growth stocks like Apple, Amazon and Netflix. I maxed out my 401k and set aside money to invest in my brokerage account.

My wife and I paid off our mortgage many years early.

See my posts on savings here and here for some of the things we did to help set aside money for investing.

Retirement

Retirement is a big shift in strategy for me. While I still rely on growth investments to fund my spending 10-20 years down the road, I need investments that provide income today. I want a regular paycheck. And I’d like to get it without working.

Annuity

An annuity is an insurance product where we give an insurance company a large chunk of money today in exchange for a lifetime income stream. I wrote a derailed post about annuities here.

Annuities often get a bad name because if you compare the lifetime return of an annuity against the return of the S&P 500 for almost any period in time, the S&P 500 wins by a long shot.

That said, nothing about the S&P 500 investment is guaranteed. An annuity is guaranteed. For those who want dependable income, an annuity may make sense.

I Can Do Better

I’ve researched annuities and considered buying one. My wife and I even attended a couple of seminars on annuities. The guaranteed income is attractive, but I think I can do better on my own.

Am I right? Time will tell.

Income Investments

To obtain that regular paycheck, I’m moving to income-producing investments.

I’m maximizing the return on my cash. Read more here and here.

I’ve also invested in a number of companies that pay a high annual dividend. T.Rowe Price (Ticker: TROW) is a great example. It pays a 5.39% anual dividend. Read more here.

I recently wrote about some bond fund alternatives that generate some income. Read here.

Invesco Senior Income Trust

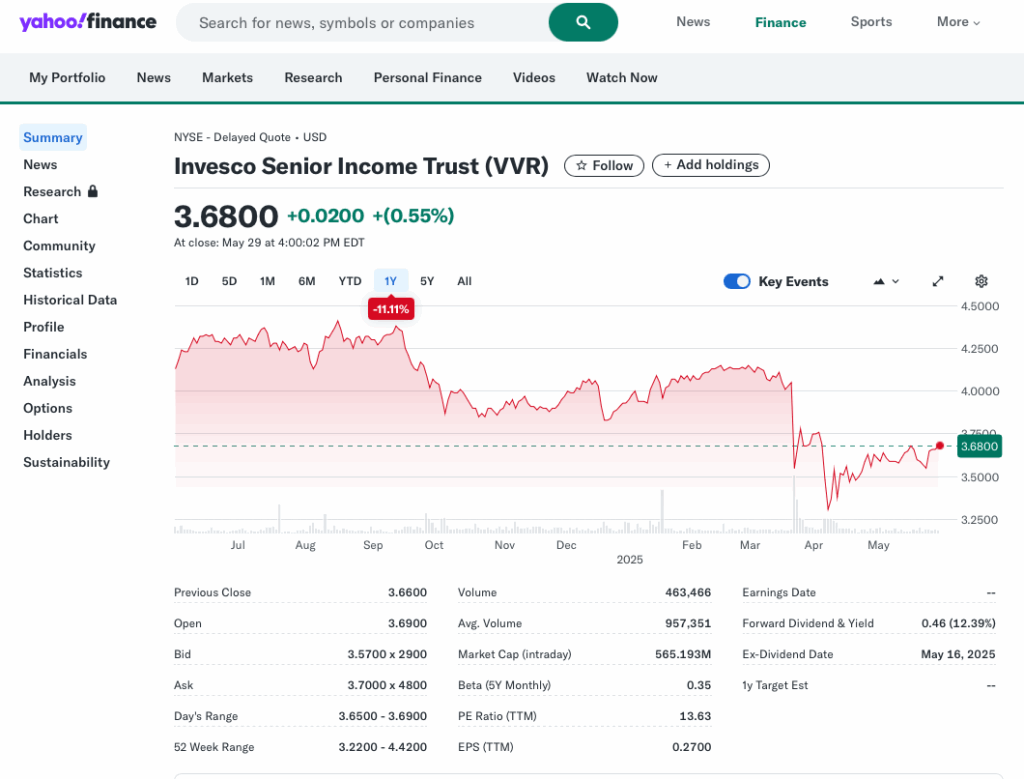

Today we’ll take a look at the Invesco Senior Income Trust (Ticker: VVR). I like this investment even though the stock price is down 11% over the last year.

Here’s why I like it.

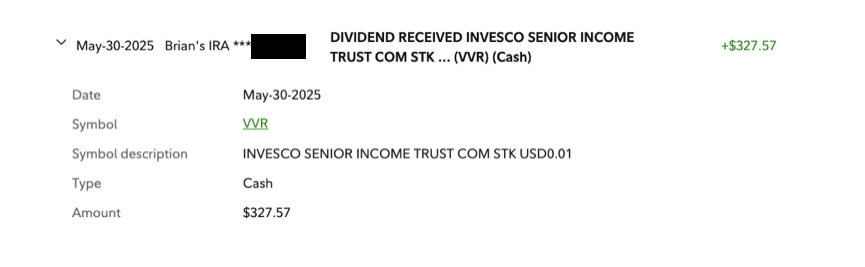

About $327 shows up in my account every month. There’s that paycheck we talked about.

What is VVR?

Closed End Fund

VVR is a closed end fund. Most common mutual funds are open end funds.

With an open end fund, the fund buys more securities when investors buy fund shares and it sells securities when investors redeem fund shares.

A closed end fund works a little differently. A closed end fund buys a basket of securities (just like an open end fund does) and then packages them as a security. As an investor, we cannot buy more shares through the investment company like we can with an open end fund. Instead, the shares are traded on an exchange. We must buy shares from another investor.

For everything you ever wanted to know about mutual funds, read here.

Bank Loan Fund

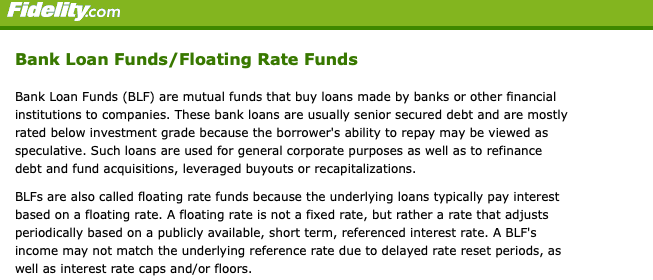

The folks at Morningstar are nice enough to categorize funds based on what they hold. VVR is a Bank Loan fund. Here is some info from Fidelity about what a Bank Loan Fund is.

Senior Debt

The Invesco Senior Income Trust invests in senior debt.

Senior debt is somewhat less risky as it is debt that is prioritized for repayment should a company go bankrupt. Remember, these bank loans are high risk debt. I drove by a new development yesterday and they have a sign that says “This development financed by Unibank.”

Unibank is one of our local banks. Local banks make money by financing community projects using depositor funds. These loans tend to be risky. What if the developer doesn’t complete the project? What if they do, but then they can’t fill all the units in the development?

To offset these risks, the loans are often categorized as senior debt, which will be paid off first in a bankruptcy. This means that the senior debt-holders will likely get some piece of their investment back.

And to reduce risk even further, banks will package up some of these loans and sell them to investment companies like Invesco, who will create an investment fund (like VVR) which they will then sell to investors.

High Yield

Because these loans are generally categorized as below investment grade, or junk, borrowers pay a high rate of interest. This is good for fund investors. Take a look below the chart above. VVR yields 12.39% per year.

OK, So What Do We Own?

That’s a lot. Essentially we own a mutual fund. This fund is made up of a group of bank loans. These loans have a variable rate of interest so in addition to the risk of bankruptcy, the yield will fluctuate along with interest rates. 12.39% today doesn’t guarantee 12.39% tomorrow.

Some loans may default, but hopefully because we’ve got a package containing lots of loans, and because we are getting a high rate of interest, our investment will pay off in the long-run.

Volatility

But yeah, prepare for volatility. This year, the fund directors decided not to “prop up” the rate of return and the fund price tanked – that’s why the 11% drop. With interest rates falling, the only way the fund could continue paying the existing rate was to sell assets. That’s not a good strategy, thus the change and the price drop.

And the rate of return dropped a bit. It had been up around 14%.

Bummer. But still paying 12.39%.

Sheesh!

So why own this – sounds like a lot of volatility and risk.

I wouldn’t put a large chunk of money here. I’ve invested about $30,000. 12.39% of $30,000 = $3,687 per year. The fund pays out monthly, so I get $327 this month. Yay!

Annuities – Remember Them?

So, we said we liked the guarantee of the annuity, but we felt we could do better.

Another big problem with the annuity is that while we get regular payments throughout the contract, we get nothing at the end. Our nest egg is gone.

So let’s think about investments like TROW and VVR as our own little do-it-yourself annuity.

TROW pays 5.39% per year and makes quarterly payments.

VVR pays 12.39% per year and makes monthly payments.

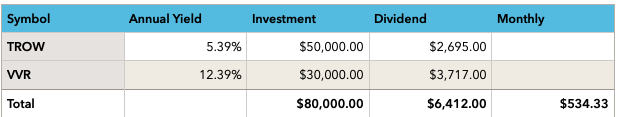

Here’s a chart to summarize

My monthly paycheck is $543. I invested $80,000. That’s a lot of money to invest, but not my entire savings.

I have a balanced asset allocation strategy where I have short term needs in cash, long term growth investments in stocks like Amazon, Apple and Netflix, and some money like this invested for income.

I don’t need these particular income investments to grow. That’s what I have growth stocks and S&P 500 fund shares for. I’m OK if these stay flat or even decline a little.

Both of these have declined. And that’s OK. I’m still getting a solid paycheck and unlike the annuity, there will likely be something left over at the end.

Wrap Up

In order to have a successful investment strategy, we need a solid asset allocation plan to meet our spending and our long term growth needs.

As we enter retirement, it becomes much more important to have some investments that generate current income. We still need growth investments to make sure we’ve got money in 20, 30, even 40 years, but we need to move some of our investments into vehicles that will pay us a high rate of current income.

And while we like the guarantee part of an annuity, we may not like the idea of having nothing at the end.

There are investments like TROW and VVR that may be worth looking onto to help us get some income while maintaining a reasonable likelihood that we’ll have some money coming back at the end.