As investors, we put our capital to work by buying securities in the expectation that they will increase in value over long periods of time. In order to assess our progress, and the wisdom of our choices, we need to measure our performance. This is easier than you may think. Read on for some suggestions and examples.

The Easy Way

I’m a bit of a nut about measuring performance. I do my best not to react, but I like to monitor my investment decisions and the results they have on my portfolio. For me it provides insights and I believe it makes me a better investor.

However, some people have real jobs and don’t have the time and interest to go to the level we’ll talk about here. That’s OK. There are lots of websites, including your brokerage website, that will provide meaningful information to you so that all you need to do is click. This is sufficient for most people so feel free to get off at this stop. We have plenty of other great posts – see our blog page. For the rest…saddle up (sorry about the mixed metaphors…trains and horses)

Performance Benchmarks

Not as complicated as it sounds. A performance benchmark is the security or index that you want to compare to. Here’s a simple example. If I decide to buy an actively managed fund, for example, the Fidelity Contrafund, I would expect that if I’m paying for active management, Fidelity Contrafund would outperform a low-cost S&P 500 index fund. We’ll talk about why in a second, but my goal is to outperform the index, so my benchmark is the index, or an index fund – I pick.

Paying for Active Management

I’ve proclaimed my love for low-cost S&P 500 index funds & ETFs many times. They are a great way to invest in the 500 largest companies in the US. Their cost is low (remember the expense ratio? Go back to the post on mutual funds to read more).

Index funds have lower expenses because all the buys and sells are done (typically quarterly) based on the changes in the underlying index. There is no fund manager making decisions or research team analyzing sectors and companies.

Actively managed funds do need fund managers and researchers because they are making buy/sell decisions on their own with the expectation that they can do better than the index.

Measuring Against the Benchmark

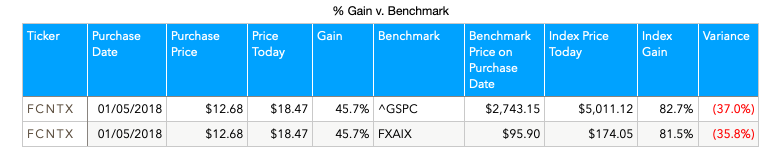

I’m buying Fidelity Contra (FCNTX) and I want to measure its performance against a benchmark of either the S&P 500 Index (ticker: ^GSPC) or a low-cost S&P 500 fund like FXAIX.

The Easy Way (2)

For little to no effort, you can navigate to yahoo finance type in FCNTX, click on chart, add a comparison to the S&P 500 index and FXAIX. You will get a chart that looks like this.

We can see that over the last 5 years, FCNTX has under-performed both the index and the index fund. The index and the index fund are almost identical. The fund is slightly lower because it has a .01 expense ratio meaning you pay $1 in fees per year for every $10,000 you invest. Pretty good deal.

And we can change the time period, or put in a custom date range where we could set the start date as our actual purchase date to see the exact comparison. How did our purchase of FCNTX compare to the performance of the index and the index fund?

Very easy, nothing to maintain and it’s flexible. We can easily add comparisons to other funds or indices.

Less Easy

Still easy but requires some effort.

I have over 100 investments; stocks, bonds and mutual funds. Comparing them all as described above would be quite time consuming. Luckily the MS-Excel and Mac OS Numbers spreadsheet programs, and probably others as well, have an imbedded stock function which can be used to get current or historical prices. Let’s take a look at a simple spreadsheet to monitor performance against a benchmark.

Let’s go column by column. In the ticker column is the security I bought. Purchase date is the date I bought shares. Purchase price – in this case since it is hypothetical, I used the stock history function to return the closing price on the purchase date. If I were trading an etf or stock that trades on an exchange, I may want to type in the actual price paid per share.

Price today uses the stock function to get today’s price for FCNTX. Gain is a formula calculating (price today – purchase price / purchase price. The benchmark is the symbol I choose to compare against. Using the same purchase date, I use the stock history function to get the benchmark price on that date. I use the stock function to get the benchmark price today. I then use the same calculation for index gain, and compare FCNTX gain to the index gain.

FCNTX under-performed both indices, and the fund slightly underperformed the benchmark as we expected.

I can add a row for every single purchase I’ve made, choose a different benchmark for each, and see quickly how each did against its benchmark.

But What About Dividends (and Cap Gains)

I’m glad you asked. This analysis is strictly on stock price. Many of the companies within the S&P 500 index pay dividends and capital gains. FXAIX pays dividends and capital gains. Don’t we need to factor this in? Absolutely.

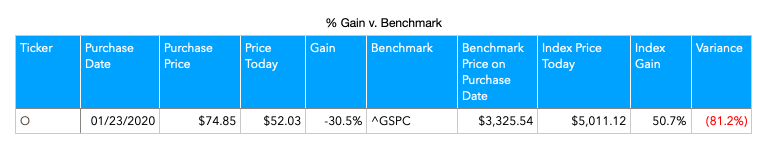

Let’s say I bought Realty Income ticker: O. In yesterday’s post, I talked about how it has hugely underperformed the market, but my poor performance was lessened because of the 4+% dividend. Let’s look at Realty Income.

Ouch! Down 30.5% and 81.2% behind the index.

But don’t forget that Realty Income pays a dividend every month. It is the monthly dividend company. The total dividend is about 4.25% per year, so over 4 years, I’ve gotten 17% back in dividends.

How do I put that in the Spreadsheet?

I’ve done this. I’ve added calculations for how many quarters I’ve held and what the dividend was, but then I realized I was going a bit off track. Big surprise. Here’s what I came up with instead.

What’s My Benchmark?

Why would I compare Realty Income to the S&P 500? I chose Realty Income largely for the consistent and growing dividend payment. I expect the share price to grow very little, but I expect that it will continue to pay a dividend that I can use to pay for some of my spending in retirement. A comparison against the S&P 500 which is more growth focused isn’t a valid comparison.

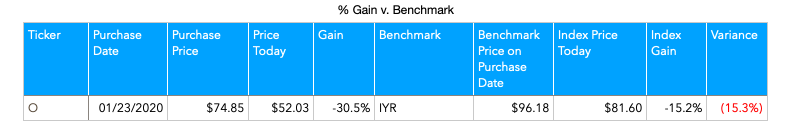

Instead, I chose to compare to the iShares US Real Estate ETF ticker: IYR

IYR yields 3%, where O currently yields 5.9%. So while it has lagged the benchmark, the extra yield makes them reasonably competitive.

But anyway, the point is, choose a realistic benchmark. What are your expectations for the investment and what are your options for comparison.

VYM

The Vanguard High Dividend Yield Index Fund ETF. VYM Yields around 3%, which is more than double an S&P 500 index fund. On a couple of occasions, I bought this fund based on the higher dividend yield, however, in my spreadsheet, I compared it to the S&P 500. On price appreciation alone, it always lost out. Subsequently I cursed the fund and sold it. Looking back, this was a mistake. While it consistently lags the performance of the S&P 500, that’s not the fund’s goal. It invests in dividend paying blue chips. I should have had a better comparison. (and held onto my shares of the fund)

Capital Gains

I got distracted but I’m back. Many mutual funds pay out short term and long term capital gains at the end of the year. Funds buy and sell securities throughout the year. Even passively managed funds do when they rebalance to their associated index.

Buying and selling will cause the fund to incur capital gains or losses, just as we would if we were buying and selling those securities. Funds will generally keep track of this during the year and sometime in December, they will pay out any net gains to the shareholders.

This is cool. We either get cash in our brokerage account or the money is reinvested in additional shares of the fund. Not so cool come April because we (yes us, the shareholders) need to pay the taxes. We are the owners of the securities (albeit through the fund) so we’re responsible for taxes on any gains.

Cap gains can be wildly different from year to year. A fund may payout one year and not the next. I haven’t found a way to include these in my calculation. I just look at it like a Christmas bonus when it happens.

Another Cool Site

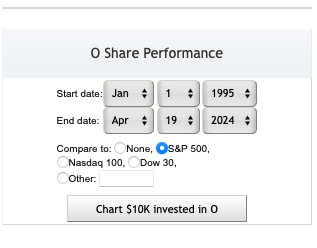

This site will ask you to enter an email address to log in.

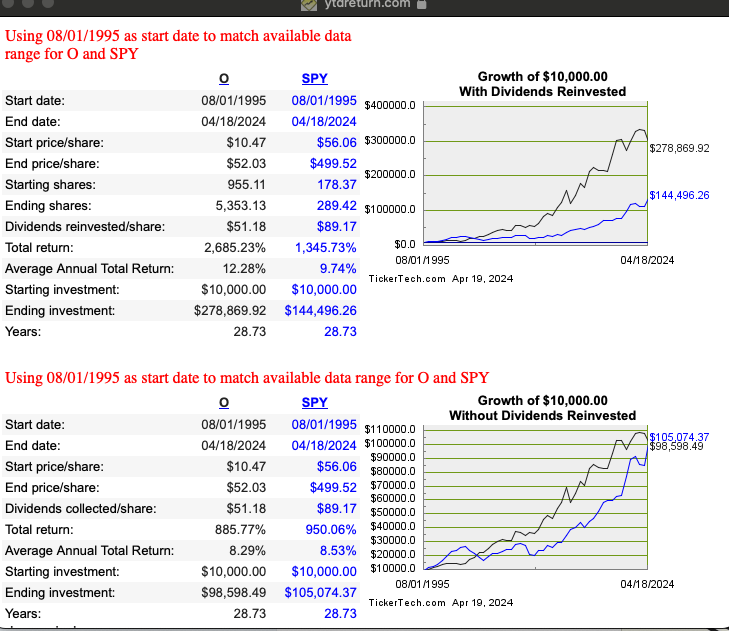

Once on the site, there is a neat feature that allows you to chart performance with dividends reinvested against an index.

There’s a little widget on the bottom left that looks like this

You can then get a chart that shows you a comparison if you had invested $10,000 with and without reinvesting dividends.

This is our old friend Realty Income. With its huge monthly dividend reinvested, you would have been far better off in Realty Income than in a low-cost S&P 500 index fund. Note the difference if you did not reinvest dividends. Sure you would have had a good chunk of cash each month to spend, but reinvesting dividends can have a huge impact over many years. It’s also guaranteed dollar cost averaging.

Wrap-Up

Choose your benchmarks wisely and build a spreadsheet. This will help see how your investments are performing. And remember, this is one input of many you should be looking at . Don’t rush into sell decisions without giving your investment some time to grow, and without considering other factors. Read the post on investment thesis for more.

Thanks for reading. Let me know what you think.